Auto Repossessions Hit Lowest Level in 7 Years

2.2 million vehicles are repossessed every year (2022 updated data) 5,418 repossessions every day 226 car repossessions each hour 3.76 repossessions a minute 2021-2022 most repossessed car and truck (in order) Ford F-150 - is the most repossessed truck Chevy Silverado - is 2nd the most repossessed truck Honda Civic - is the most repossessed car

Auto Loan Defaults Are Increasing, But We Are Not Heading Into A Repo

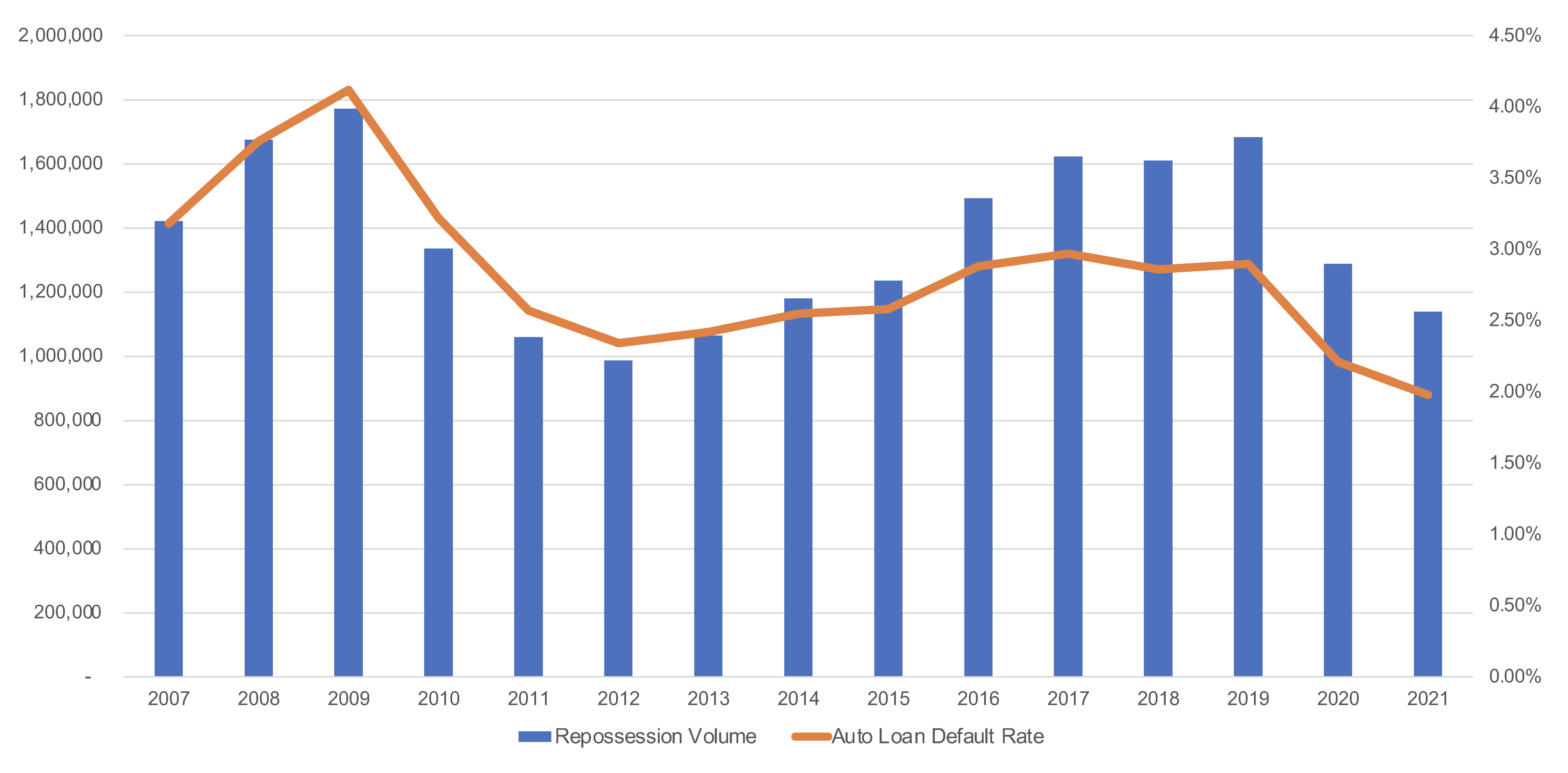

The Outlook: It is expected that defaults and repossessions in 2023 will continue to increase compared to 2022 but will not reach red-alert levels. The healthy job market, coupled with stronger consumer balance sheets and relatively stable vehicle values are expected to keep defaults and repossessions at relatively low levels.

Car Repossession Statistics 2022 Fast Title Lenders

(IBIS World) #2. For the 5-year period ending in 2017, the repo industry experienced an annualized growth rate of 3.6%. That results in a total market value of about $1 billion each year. ( IBIS World) #3. Since 2012, repossessions within the auto industry have been climbing steadily.

Car Repossession Statistics

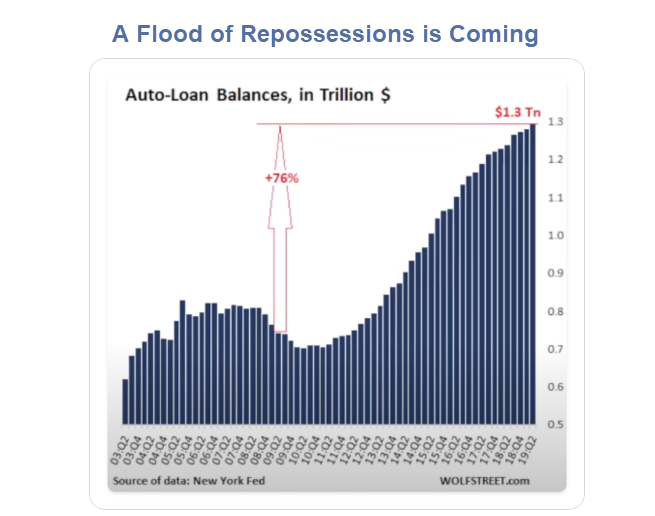

Repossessions occur when a borrower falls behind on their car payments, giving the lender the right to seize the vehicle. The rise in repossessions comes after car prices surged during the.

Car Repossession Statistics 2022 Fast Title Lenders

1. Although the focus of this bulletin is UDAAPs, the Bureau notes that certain provisions of the Fair Debt Collection Practices Act and its implementing Regulation F may also apply to the repossession of automobiles. Fair Debt Collection Practices Act, 803 (6), 15 U.S.C. 1692a (6); 12 CFR 1006.2 (i) (1) (effective November 30, 2021).

Auto Repossessions Are on the Rise, As People Walk Away From Car Loans

One auto auction company, Manheim, reported: "The number of repossessed cars increased 11% in 2022 compared to the prior year, but that was still down 26% from 2019."

How to locate your car after repossession? Consumers Law

By Shannon Pettypiece WASHINGTON — A growing number of consumers are falling behind on their car payments, a trend financial analysts fear will continue, in a sign of the strain soaring car.

Repossession Lawyer Auto Repossession Attorney Athens GA

Mark Huffman, Reporter. • Jul 26, 2022. From dealers to lenders to tow truck operators, reports have poured in this month about a disturbing trend of rising car and truck repossessions. Lisa.

Missouri Auto Repossession Laws Requirements & Help

Geoff Cudd We all know that car prices have gone up in the post-pandemic world, but we may not have considered how much the supply chain issues have affected car loans and repossessions. Our expert editors have curated 47 statistics on car loans and repossessions for 2023 so that you have an easier time navigating your car-buying experience.

A Flood of Repossessed Cars Poised to Hit the Used Car Market MishTalk

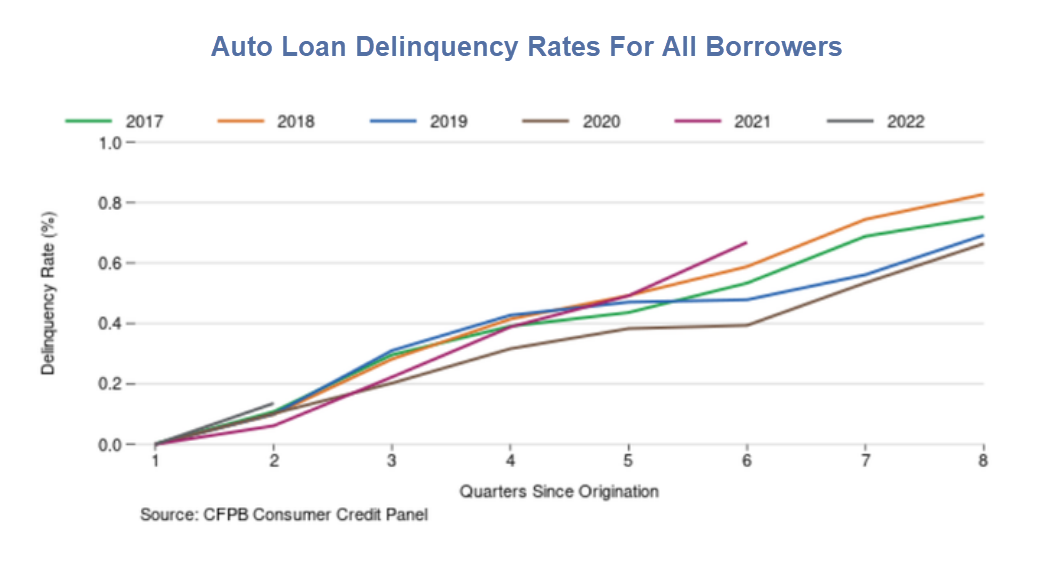

3 min read Smoke on Cars Don't Panic: Loan Defaults and Repossessions Are Rising, and That's Normal Wednesday December 21, 2022 In today's market, the deterioration of consumer credit, and auto loan performance, in particular, is a worrying sign for industry watchers.

Are You the Victim of a Wrongful Auto Repossession? Consumers Law

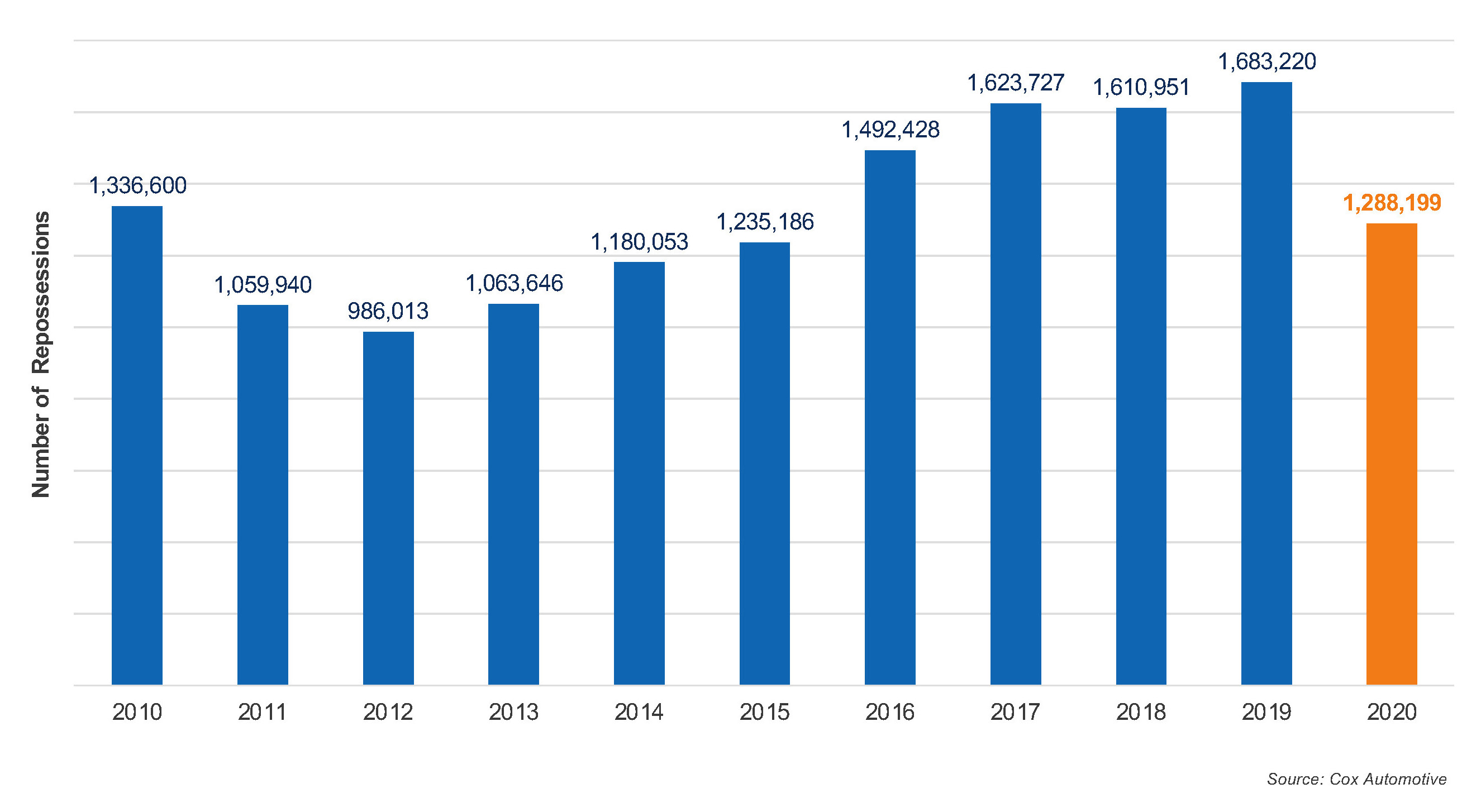

January 15, 2021. ATLANTA - Cox Automotive estimates that repossession volume will make a "significant" rise in 2021 compared to last year. According to data shared during Friday's Cox Automotive Industry Insights 2021 presentation, repossession volume in 2020 softened to the lowest level in five years, sliding to 1.4 million units.

Repossessions are Down, Thanks to and Stimulus Cox

WTVD New data is showing the number of car repossessions is hitting its highest rate in years. According to Fitch Ratings, more Americans are falling behind on their car payments after a sharp.

Auto Repossessions Are on the Rise, As People Walk Away From Car Loans

General Car Repossessions on the Rise By Sean Tucker 12/20/2022 8:11am Car repossessions have grown less common for the last two years, but those days may be over. Credit rating agency Fitch.

Auto Repossession and the Pandemic Consumers Law

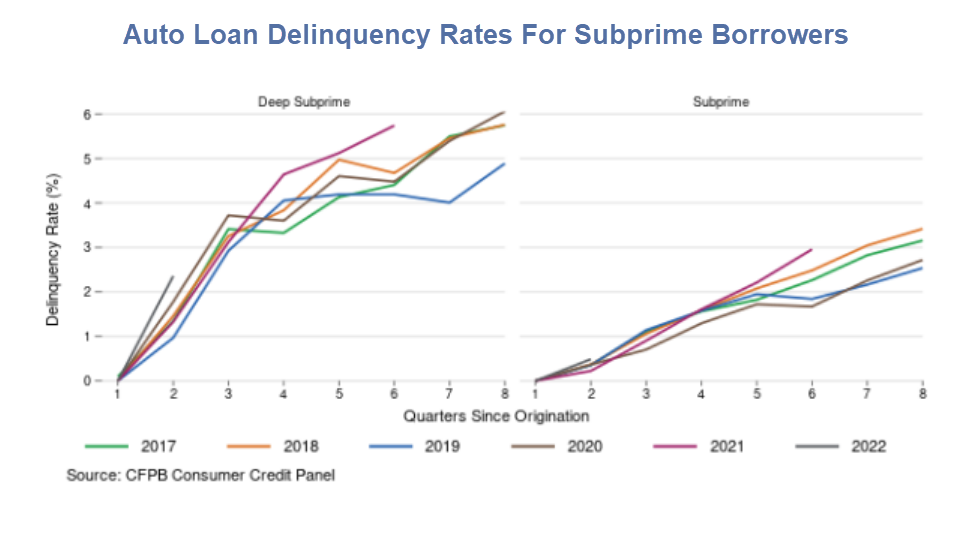

2022 delinquency rates continue to rise The strong credit trends during the pandemic are returning to normal levels, exemplified by auto loan performance this month. According to Cox.

Auto Repossession What It Is and What to Do About It

Per CFO Vickie D. Judy, the company, government stimulus money has helped shrink car loan charge-offs, even when consumers are financing greater amounts thanks to increased used vehicle prices. Higher car repossession rates also kept charge-offs lower, with the company achieving 28.5% for the past quarter versus 27.1% a year ago and 26.6% two.

Average Auto Loan Balance Increases to 22,612 Experian

Cox Automotive estimates that the share of defaults ending up as repossessions declined from the more typical 80% in 2020 to below 78% in 2021. As a result, 2021 likely saw approximately 1.1 million repos, down from an estimated 1.3 million in 2020 and 1.7 million in 2019. Historical Repossession Volume and Auto Loan Default Rate