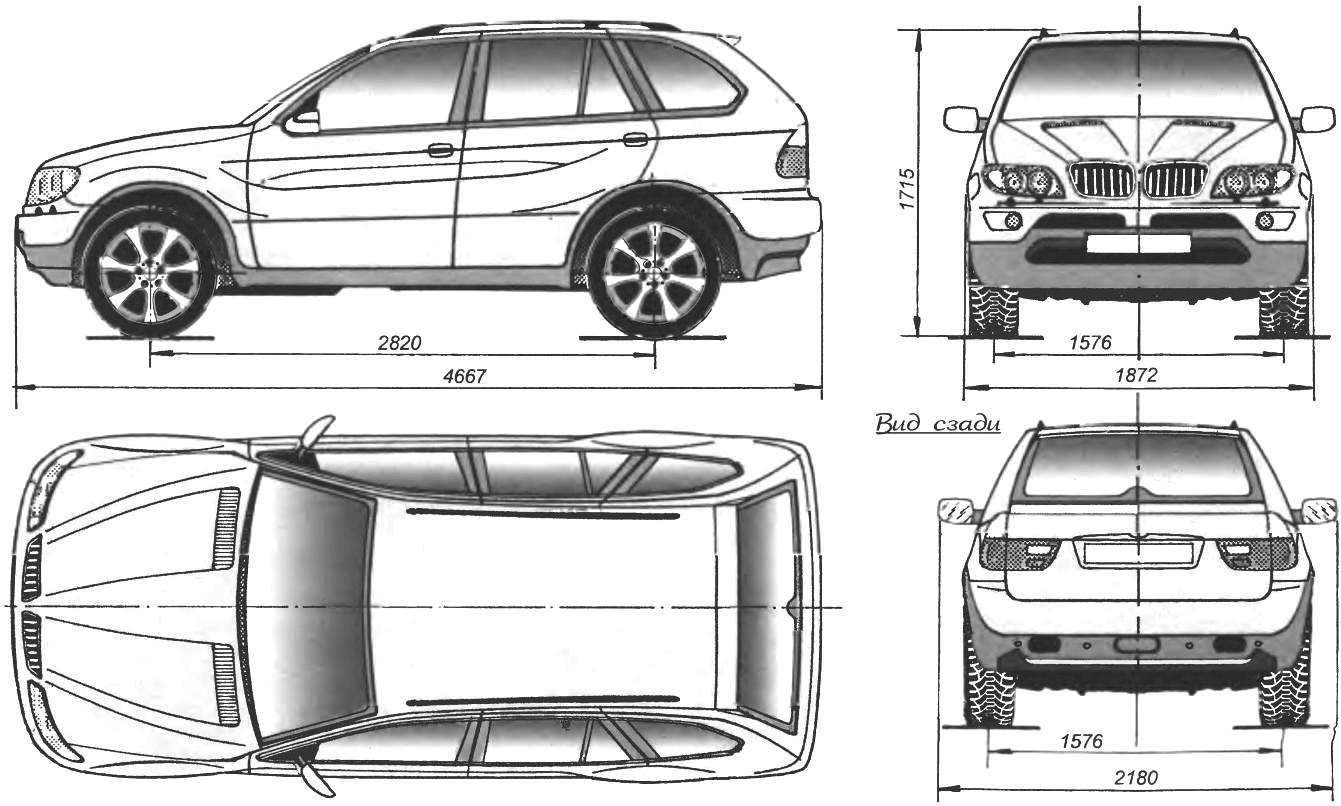

2015 BMW X5 Carbon Fiber Fibre Body Kit Body Kit BMW X5 F15 AF1

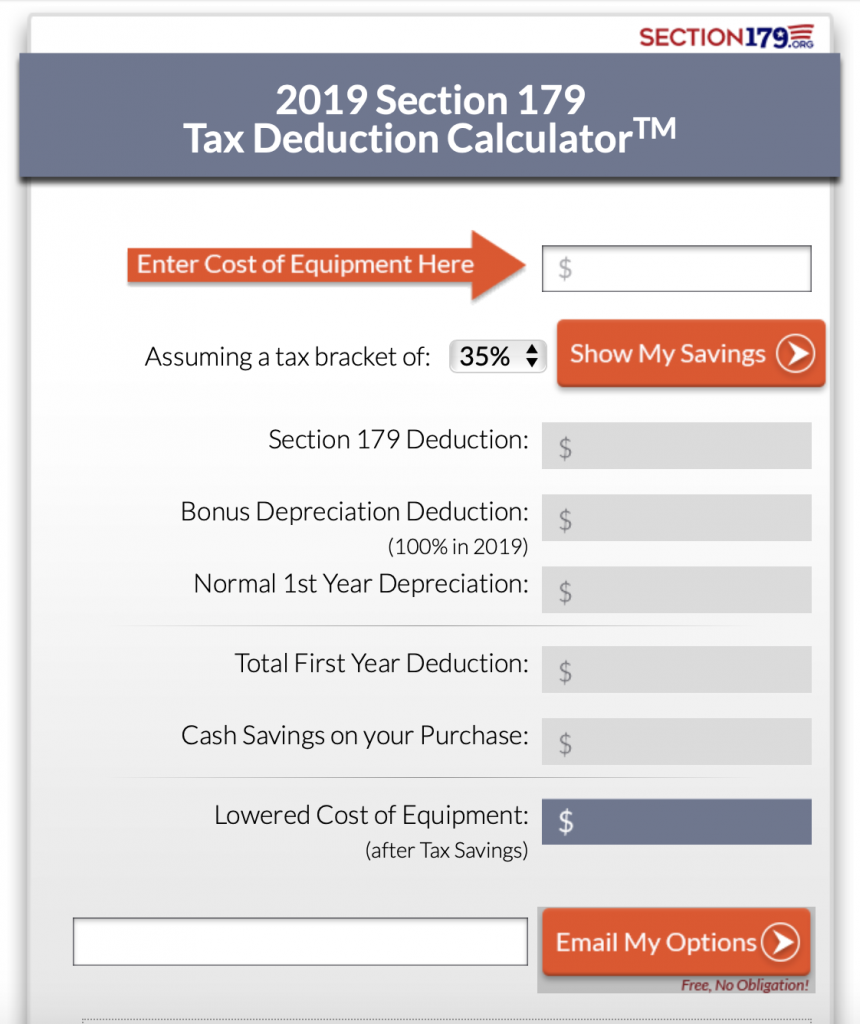

Section 179 of the IRS Tax Code allows businesses to write off the complete purchase price of any qualifying piece of software or equipment in the year it was purchased or financed. For example, if a business financed $50,000 worth of equipment in 2021, it can deduct the entire $50,000 from its 2021 taxable income.

BMW X5 XDrive25d M Pakiet Salon Polska/Gwarancja Import samochodów z

Comparisons based on Section 179 and 168 (k) of the Internal Revenue Code, which allows for additional first year depreciation for eligible vehicles and reflects figures for owners who purchase vehicles for 100 percent business use and place vehicles in service by December 31, 2023. Information presented subject to change.

FileBMW X5 II 20090913 rear.jpg Wikimedia Commons

Purchase a BMW luxury model with a gross vehicle weight rating of over 6,000 pounds, such as the BMW X5, X6, or X7. 2.) This car must be purchased before December 31, 2022.. You may be eligible for increased first-year depreciation on qualified vehicles, such as the BMW X5, X6, or X7, under Section 179 and 168(k) of the Internal Revenue Code.

BMW X5 Trim cover, bumper, primed, front. PDC 51118037267 BMW

Answer: Yes, the BMW X5 does qualify for Section 179. Section 179 of the IRS Tax Code allows businesses to write off the full purchase price of certain qualifying equipment and/or software purchased or financed during the tax year. The BMW X5 meets the criteria to be eligible for this deduction. How Much can I Deduct with Section 179?

BMW MODELS THAT QUALIFY FOR SECTION 179 TAX DEDUCTION BMW of

Section 179 for Vehicles To qualify for the Section 179 deduction, you must use a vehicle for business purposes (as opposed to personal use) more than 50% of the time. If used for 50% or less, you will not qualify for any Section 179 deduction. Typically, owners calculate business use based on mileage. Can I write off a 6000 lb vehicle 2022?

FileBMW X5 M.jpg Wikimedia Commons

The short answer to this question is: yes! The BMW X5 is eligible for Section 179 deductions - and that makes it an even more desirable choice for those looking to save money when buying an SUV. Section 179 of the Internal Revenue Code allows businesses to take an immediate tax deduction of up to $1 million on certain qualifying expenses.

BMW X5 XDrive25d M Pakiet Salon Polska/Gwarancja Import samochodów z

X5 qualifies for Section 179 Tax Deduction for business use.

Does Bmw X5 Qualify For Section 179?

BMW Approved Wheels and Tires; BMW M Performance Parts;. BMW X5 PHEV Starting from $90,500 . Build & Price; Find Out More; BMW XM Starting from $220,000 .. For province-specific pricing please refer to the Build & Price section of the website. Total Selling Price may vary by province.

BMW X5 CARINTELLECTUAL MODEL CONSTRUCTION

As there's probably CPA's among the forum members, maybe you can chime in on the X5 eligibility for business tax deduction under Section 179. I am getting conflicting information, some people say that the X5 falls under so called "luxury vehicle limitation" limiting the amount to something of $3,000 per year.

BMW X5 Grommet, trunk lid 61139229745 BMW, Stratham NH

Technology Highlights. Plug-in hybrid. Search Inventory. With the BMW X5, you experience exceptional interior comfort and innovative functionality in a sporty design: Powerful BMW TwinPower Turbo 6-cylinder combustion engine with 375 hp. [1] (X5 xDrive40i) Revised front fascia, slim headlights, and optional Illuminated Kidney Grille.

2002 BMW X5 E53 2.9 (179 cui) diesel 135 kW

Yes, you can finance your BMW X5 with little to no down payment and still deduct the vehicles' value under Section 179 or Bonus Depreciation. For instance, if you spend $100,000 on an X5, you can put $20,000 down, finance the rest $80,000 (over 5 years), and still claim a $100,000 tax benefit by combining IRS Section 179 and Bonus Depreciation.

2020 BMW X5 M Competition (Color Tanzanit Blue Metallic; USSpec

In this article, we'll explore whether or not the BMW X5 qualifies for Section 179. We'll take a closer look at the specific requirements and limitations of the tax code and provide you with everything you need to know before making your purchase decision. "Section 179 can be a powerful tool for businesses looking to save money on their.

BMW X5 Piping. Suspension 37236754453 BMW Northwest, WA

For 2023, these autos have a Section 179 tax deduction limit of $12,200 in the first year they are used. In fact, if the extra $8,000 of Bonus Depreciation is also factored in, you can deduct up to a combined maximum of $20,200 for 2023. Heavy Section 179 vehicles

2004 BMW X5 Actuation unit left. Seat, Front, Switch 61317119869

BMW Models that Qualify for Section 179 Tax Deduction Tax Advantages Since the BMW X5, X6, and X7 each have a Gross Vehicle Weight Rating (GVWR) which exceeds 6,000 pounds, they may be eligible for full depreciation during the first year of ownership when used solely for business purposes**.

2008 BMW X5 Rubber Mounting. Exhaust, System, Rear 18207544809 BMW

The BMW X5 may be eligible for Section 179 deductions if it is used primarily for business purposes and has a gross vehicle weight rating of over 6,000 pounds. It's important to consult with a tax professional or accountant to fully understand how these deductions apply to your specific situation.

Calculate your potential Section 179 Tax Deductions on New Equipment

The Section 179 deduction and Bonus Depreciation can be a great way to help reduce the amount of taxes you pay on your new or used BMW X5. Our Tax and Small Business blog is full of information about how Section 179 and Bonus Depreciation work, so be sure to read up before you file your taxes. Thanks for reading our Tax Blog! Learn More