Solved Depreciation by Unitsofactivity Method Miles Prior

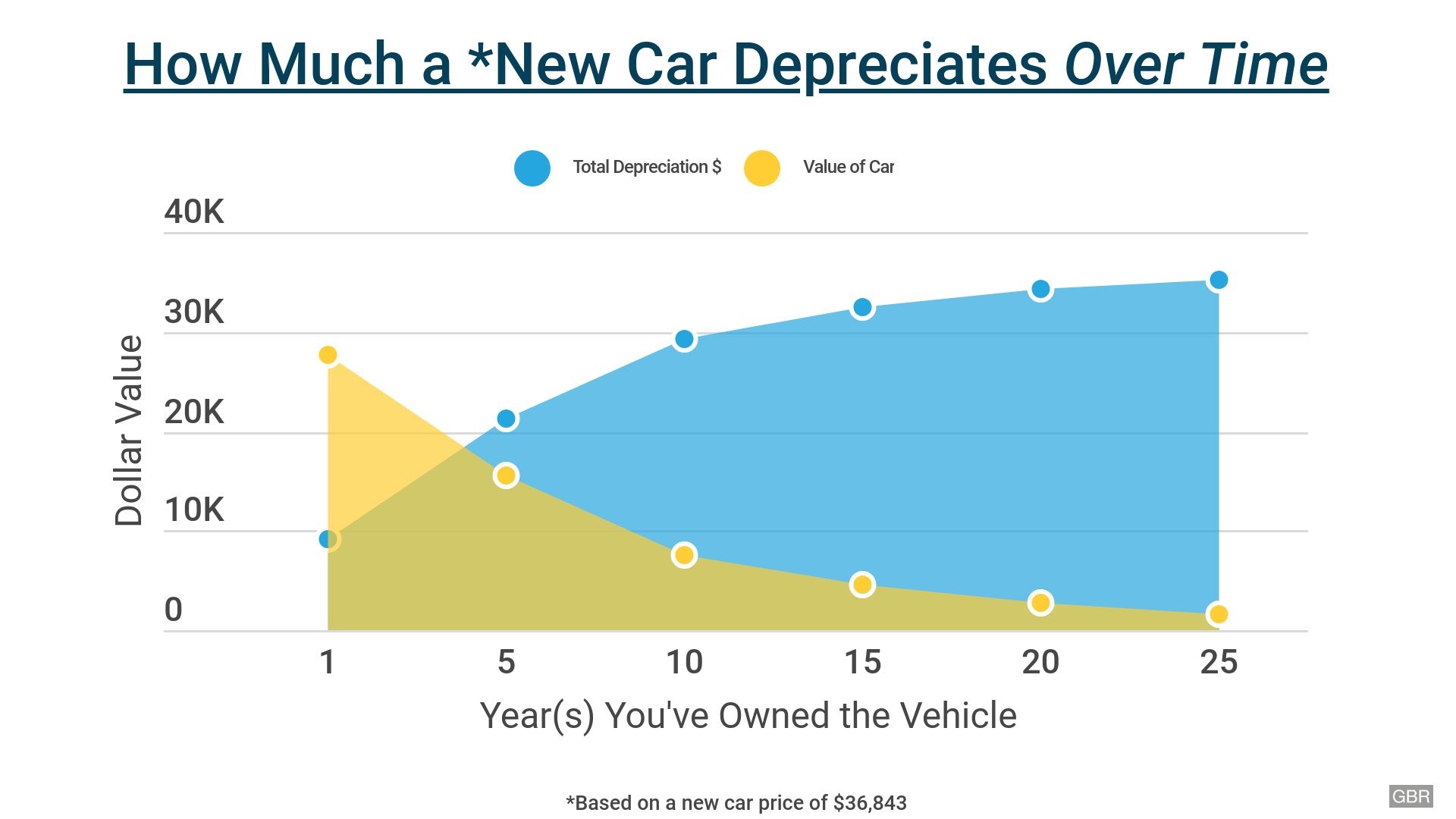

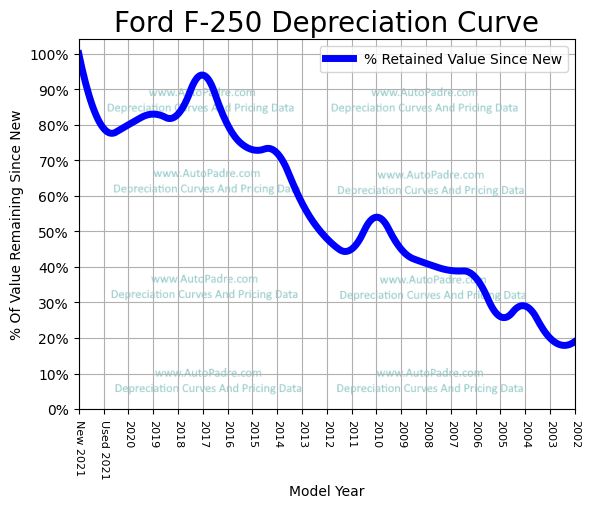

Assume a depreciation rate of 30% after the first year and 20% each consecutive year. Here, the vehicle you originally paid $100,000 for is worth only $28,672 after five years — not even 30% of its initial value. Graphic Which vehicles hold their value best? Every vehicle depreciates at a different rate.

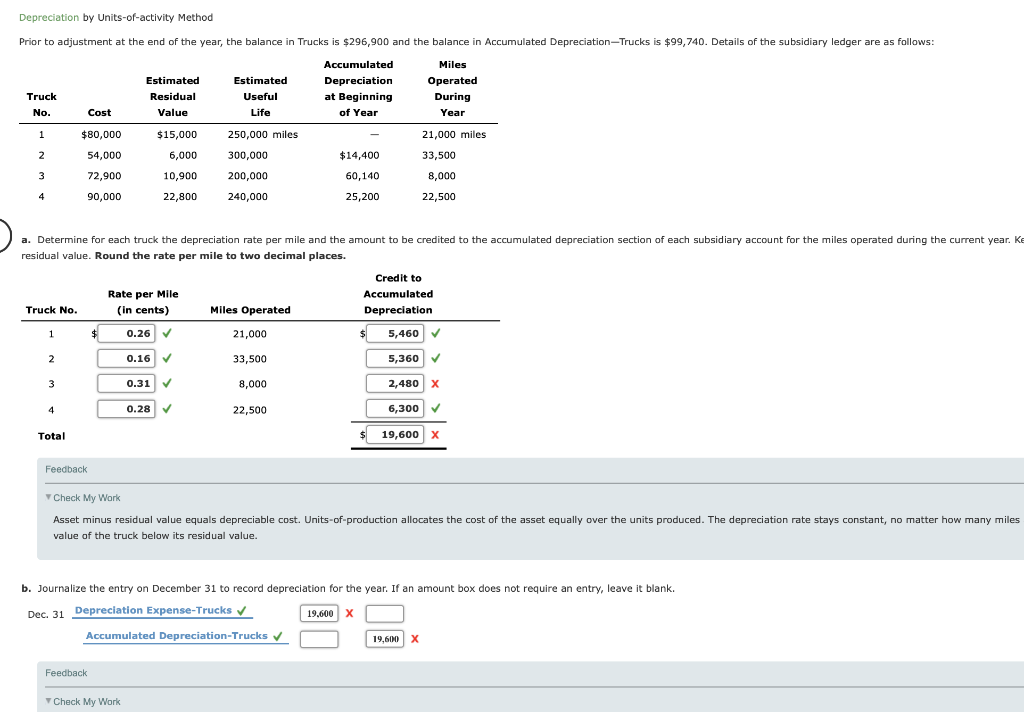

Solved Depreciation by unitsofactivity Method Prior to

Using the formula: Annual Depreciation = (Purchase Price - Salvage Value) / Years in Use Annual Depreciation = ($100,000 - $20,000) / 5 Annual Depreciation = $80,000 / 5 Annual Depreciation = $16,000 per year So, in this example, the annual depreciation of the semi-truck is $16,000 per year.

Auto Appraiser Blog

Cash. The amount of money borrowed to purchase the asset. The value of any items you traded for the new asset. The value of bartered services. Your basis will increase by the amount of major improvements you make to the property and will decrease by the amount of depreciation deductions you take on your tax return.

How Much a New Car Depreciates Over Time GOBankingRates

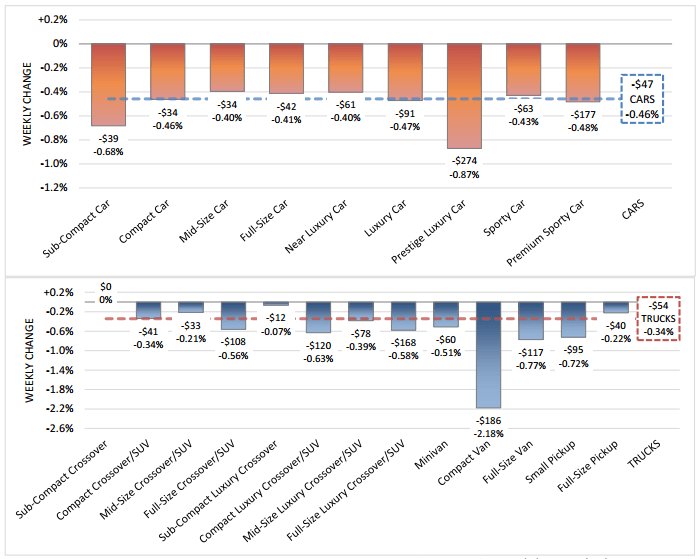

After five years, the average pickup truck's value depreciates at a rate of 36.5 percent based on the average depreciation rate of the sixteen of the most popular pickup trucks that I found on Cars.com. Pickup truck depreciation life Here is a list of the sixteen most popular pickup trucks and the associated depreciation rates (after five years):

8 ways to calculate depreciation in Excel Journal of Accountancy

Notice 2024-8 [PDF 80 KB] provides that beginning January 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 67 cents per mile for business miles driven (up from 65.5 cents per mile for 2023) 21 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed.

Depreciation Wikipedia

Depreciation limits on business vehicles. The total section 179 deduction and depreciation you can deduct for a passenger automobile, including a truck or van, you use in your business and first placed in service in 2022 is $19,200, if the special depreciation allowance applies, or $11,200, if the special depreciation allowance does not apply.

كيفية حساب الاستهلاك السنوي محاسبة 2023

The portion of the business standard mileage rate that is treated as depreciation for purposes of calculating reductions to basis will be 30 cents per mile for 2024.. (FAVR) plan of $62,000 for automobiles (including trucks and vans), up $1,200 from 2023. Under a FAVR plan, a standard amount is deemed substantiated for an employer's.

Accounting Questions and Answers EX 108 Depreciation by unitsof

Trucks Trucks & SUVs These 10 Trucks See Depreciation the Fastest In 2022 Towing and payload are your top priorities when choosing a pickup truck. But how fast it will depreciate, should also be a factor. We've got a list of 10 trucks that have depreciated the fastest after three years. by Thom Taylor Published on February 24, 2022 3 min read

Deductions to Get Your Motor Running

The IRS issued its annual inflation-adjusted update of depreciation limitations for passenger automobiles (including passenger vans and trucks) placed in service in 2021 (Rev. Proc. 2021-31).The revenue procedure similarly updates income inclusion amounts by lessees of passenger automobiles with respect to vehicles with lease terms beginning in 2021.

Ford F250 Depreciation Rate & Curve

This is because older models typically depreciate more slowly than brand-new models. For example, the accumulated depreciation for a used Sierra 1500 after 3 years is around $11,078.81, while the accumulated depreciation for a new one is around $11,501.00.

Standard Depreciation Rate Malaysia / Tax Depreciation Rates For

This car depreciation calculator is a handy tool that will help you estimate the value of your car once it's been used. You probably know that the value of a vehicle drops dramatically just after you buy it, and it depreciates with each year.

Six Reasons Why it is Also Beneficial to Buy Used Cars CYCHacks

According to the IRS, taxpayers can actually depreciate the cost of a car, truck, or van over a period of six calendar years. Why? Because a vehicle is "generally treated as placed in service in the middle of the year, and you claim depreciation for one-half of both the first year and the sixth year."

Car Depreciation What Are the Risks? CRS Automotive Hamilton

The 2022 GMC Canyon has the best depreciation curve But according to CAREdge the 2022 GMC Canyon will have less depreciation than any other truck over five years. CAREdge measures a vehicle's residual value and says that after three years, the 2022 GMC Canyon will maintain 87% of its value. After five years, that only drops to 84%.

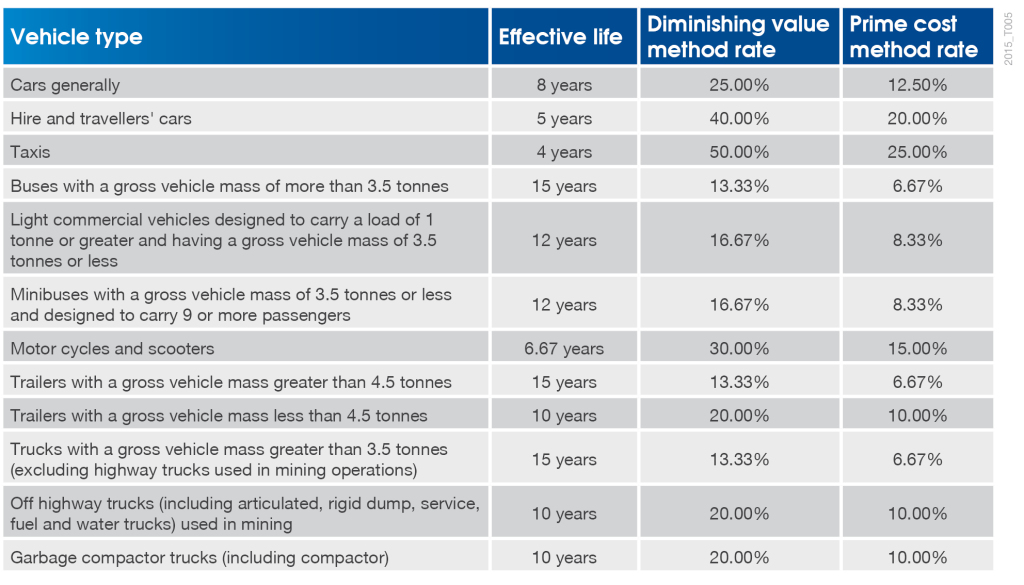

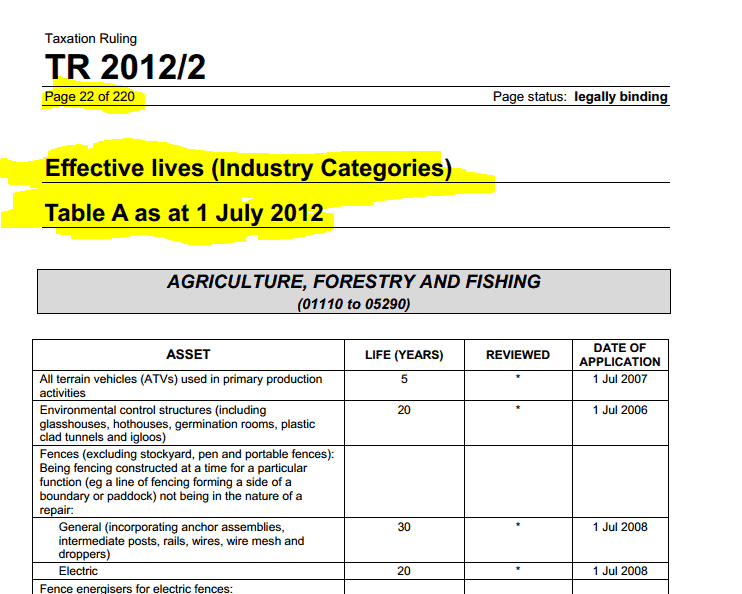

ATO depreciation rates and depreciation schedules AtoTaxRates.info

To calculate depreciation by the year, you multiply the basis amount by the percentage of how much you use the vehicle for business. For example, if you own a used semi-truck and use it exclusively for your fleet, you can depreciate its entire value and deduct its complete cost of ownership and operation. 3.

What Is A Depreciation Rate BMT Insider

Depreciation limits for trucks and vans: The depreciation limits for trucks and vans placed in service in 2014 and used 100% for business are shown in Exhibit 2. If the truck or van qualifies for bonus depreciation, discussed below, and the taxpayer does not elect out, the first-year limit amount is increased by $8,000..

Irs vehicle depreciation calculator SharryeInver

Within the first five years of ownership, a vehicle can depreciate by as much as 60%. Depreciation is not necessarily an accurate representation of wear and tear on a vehicle. You may find that after a number of years, your car has lost significant value even if it's in pristine, like-new condition.