Electric Motorcycle Tax Credit Extended in Fiscal Cliff Package

Maximizing 2023 & 2024 Personal EV Credits. Thomas Gorczynski, EA USTCP CTP. December 15, 2023. Thanks to the Inflation Reduction Act of 2022, the federal government is giving out tens of billions of dollars in tax credits to incentivize taxpayers to purchase electric vehicles. As with any government program, claiming the benefits can be.

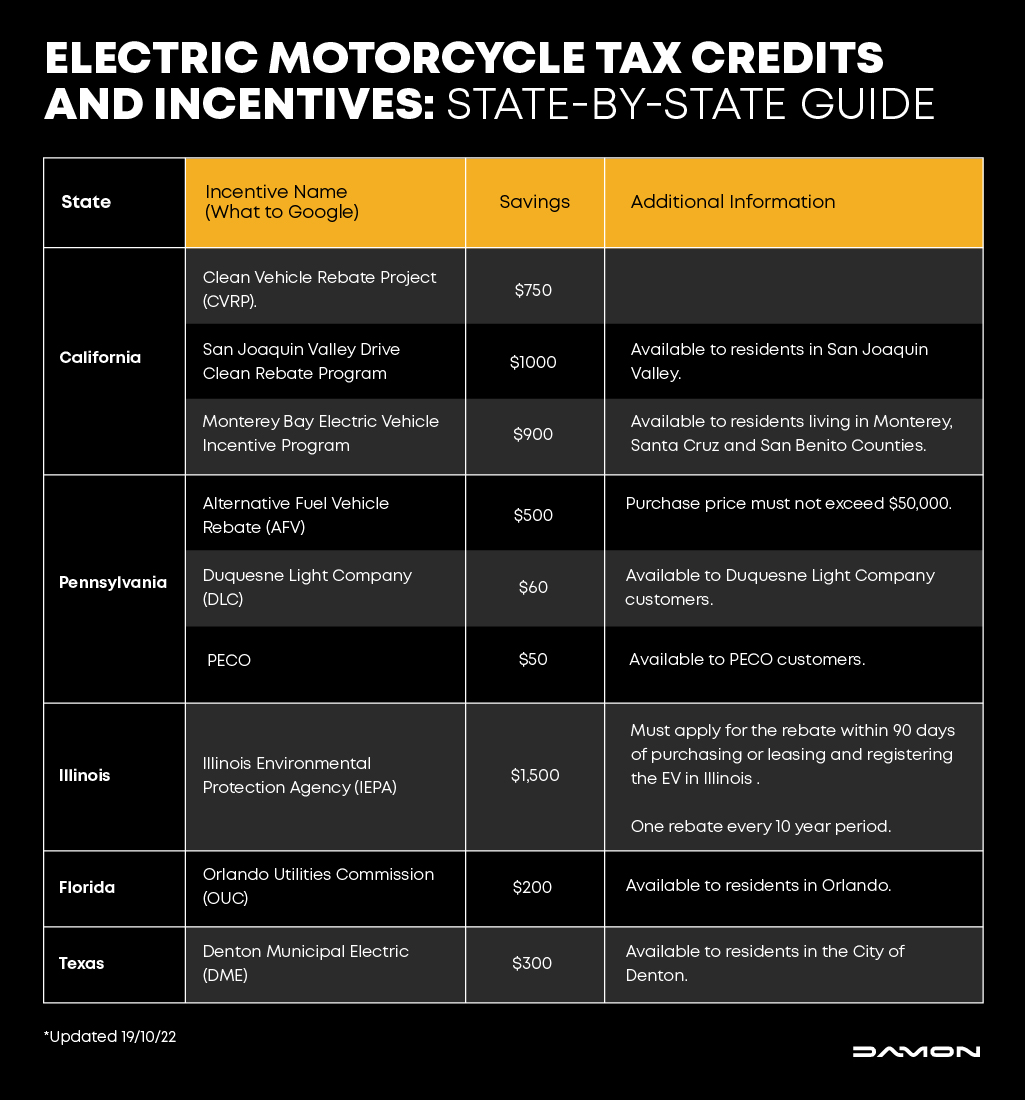

Electric Motorcycle Incentives 2023 [USA Edition] Damon Motorcycles

The new federal incentive — up to $7,500 towards the purchase of a qualifying car — may make new electric cars more accessible to some consumers, but they're still expensive. Most of the U.S.-built cars eligible for the new incentives have MSRPs between $50,000 and $75,000, with outliers like the $30,000 Nissan Leaf and the $90,000 Lucid Air.

The Complete List Of Eligible Cars For The 7,500 EV Tax Credit Carscoops

Prior to 2022, motorcycle drivers could qualify for a tax credit for the purchase of a plug-in electric motorcycle under . Section 30D(g). However, this decade-old tax credit lapsed in December 2021 and has yet to be revived. Electric motorcycles deserve the chance to compete on a level playing field with other electric vehicles. If they

Sponsored / Electric Motorcycle Incentives (Tax Credits & Rebates

Electric vehicle tax credits are getting complicated. Dec 14, 2023. 10:08. Dec 13, 2023. 1:22. Dec 12, 2023. 26:07. Dec 8, 2023. 17:58. Read More. Is "good news" good news for the economy right.

Do Electric Motorcycles Qualify For Tax Credits?

The maximum $7,500 federal EV tax credit consists of two equal parts: Battery Components and Critical Battery Minerals. In order to get the full amount, your EV or PHEV must satisfy the.

EV tax credit changes mean buyers can soon get full 7,500

Electric motorcycles already receive a 10% federal tax credit, but that figure was tripled to 30% in the new bill, according to the Washington Post. The credit was capped at a maximum of.

Top 6 High Performance Electric Motorcycle Under 10,000

What's and Most on and Federal Tax Credit for Electric Motorcycles in 2023? To Inflation Reducing Act 2022 was signed include law on August 16 th, 2022. This act removes the now-expired feds electric motorcycle tax credit, which wants have allowed riders in apply for upward to $7,500 in tax credit. The act - which also doesn't includ.

The Tax Future For Electric Motorcycles Adventure Rider

The law includes a $7,500 tax credit at the point of sale for new EVs and $4,000 for used EVs. The new tax credits replace the old incentive system, which included a $7,500 credit for new EVs and set a manufacturing cap on automakers. Beginning January 1, 2023, the cap no longer exists, and the credit scheme lasts until 2032.

How Much Does a Fully Loaded 2023 Volkswagen ID.4 Cost?

The Weekly Squeeze Share Interested in revolutionizing your ride but worried about e-bike prices? Good news! There's never been a better time to save with e-bike rebates. In 2023, there are EVEN MORE states offering tax credits or rebates to help make buying an e-bike less stressful on your wallet.

Electric Motorcycle Incentives 2023 [USA Edition] Damon Motorcycles

Federal Tax Credits for Plug-in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To $7,500! All-electric, plug-in hybrid, and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to $7,500.

Update to List of Eligible EVs (Electric Vehicles) for the Clean

Federal Tax Credits for Going Green. Federal tax credits are another way to save some green for going green. The government offers numerous tax breaks for drivers who purchase certain fuel-efficient vehicles, including: Hybrids. Plug-in hybrids (PHEV). Electric cars (EV). Diesels. Alternative fuel vehicles (AFV).

Zero Motorcycle Assures Federal Tax Credit for Electric Motorcycles

As of June 5, 2023, electric vehicle buyers in the US with certain four-wheeled vehicles that are placed in service after April 18, 2023, can potentially qualify for up to $7,500 in tax.

Electric Vehicle Tax Credit You Can Still Save Greenbacks for Going Green

In 2023, the required percentage of battery materials is 40%. This will increase by 10% annually, maxing out at 80% in 2027. For a car to qualify for the other half (an additional $3,750) of the.

Do Electric Motorcycles Qualify For Tax Credits?

Who qualifies You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032. The credit is available to individuals and their businesses.

Top 6 High Performance Electric Motorcycle Under 10,000

On the lower-end of the price spectrum, bikes like the FXE will get about $1250 off, but Zero dealers also have incentives that can add up to another $1250 on any model. Some states offer their own tax credits for electric motorcycles. Illinois is offering the most, at $1500, where California offers a Clean Vehicle Rebate Project (CVRP) of $750.

Inflation Reduction Act removes electric motorcycle tax incentive

As of January 1, 2023, electric vehicles needed to meet a few of the IRA's requirements to be eligible for any portion of the available federal tax credit. The following guidelines must be.