Mercedes Benz G63 AMG

This is one of the primary reasons millionaires love the G63 from Mercedes-Benz as the car qualifies for a unique tax deduction that other premium SUVs fall short of. Via Mercedes AMG Official Website. Due to the weight of the G63 AMG, owners can write off the car as a business tax deduction.

IPE exhaust system for MercedesBenz G63 / G500 (W464) Buy with

For tax purposes, the IRS treats heavy SUVs, vans, and pickup trucks as business equipment. This makes the vehicles eligible for a tax write-off under Section 179. While the G-Wagon is.

G63 Amg Weight How Car Specs

A Mercedes-Benz G-Class will depreciate 23% after 5 years and have a 5 year resale value of $141,544. The Mercedes G-class is not for everyone, and they're not cheap, but they do hold their value well, consistently ranking in the Top 10 among luxury vehicles. In the full-size segment, the G-class has the best value retention of any luxury model.

Mercedes G63 Looks Perfect As A Single Cab Pickup Truck CarBuzz

For vehicles placed in service in 2021, the total deduction under section 179 and depreciation for a light passenger automobile (whether new or used and weighing under 6,000 pounds), including trucks or vans, is $18,200 if the special bonus depreciation applies, or $10,200 if the special depreciation allowance does not apply.

g wagon tax write off uk Masterfully Diary Picture Show

And pay 35% in tax. That's 70k in tax. And you keep 130k. If you instead purchase a 100k car and fully depreciate it, you have 100k profit, taxed 35% with 35k tax. And you keep 65k and a car that quickly depreciates. So it "saves" you $35k - but you had to spend 100k and your car probably devalued that much in real life.

DMC Mercedes Benz AMG G63 W464 LED Roof Carbon Fiber

G Wagon Tax Write off Weight 2022 Mercedes-Benz G-Class Gross Vehicle Weight 6,945 lbs. G Class Qualifies for the 6000 Pound or more requirement (Per IRS) and using a combination of Section 179 and Bonus Depreciation. Photo Credit www.topgear.com G Wagon Tax Write off California

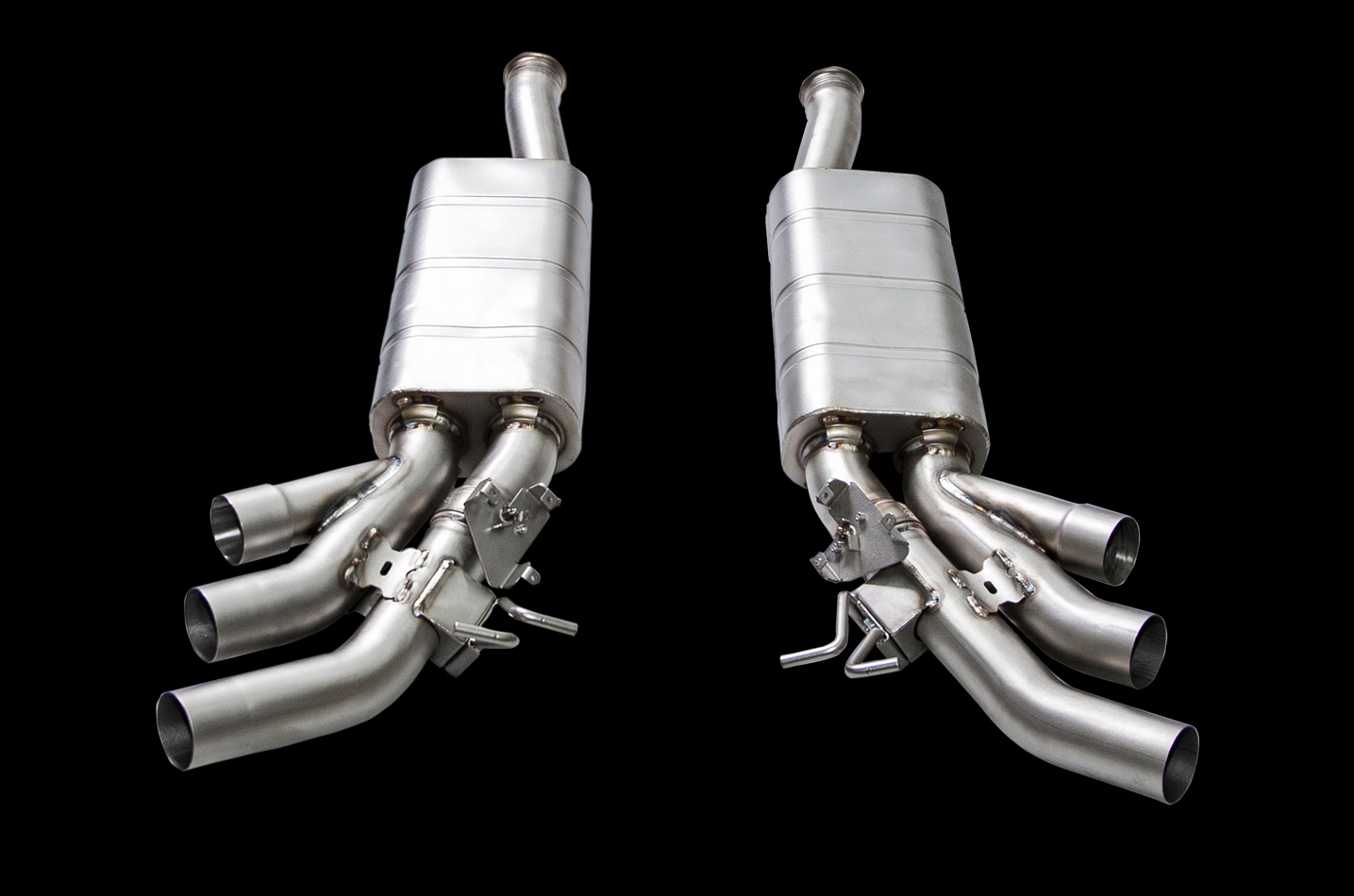

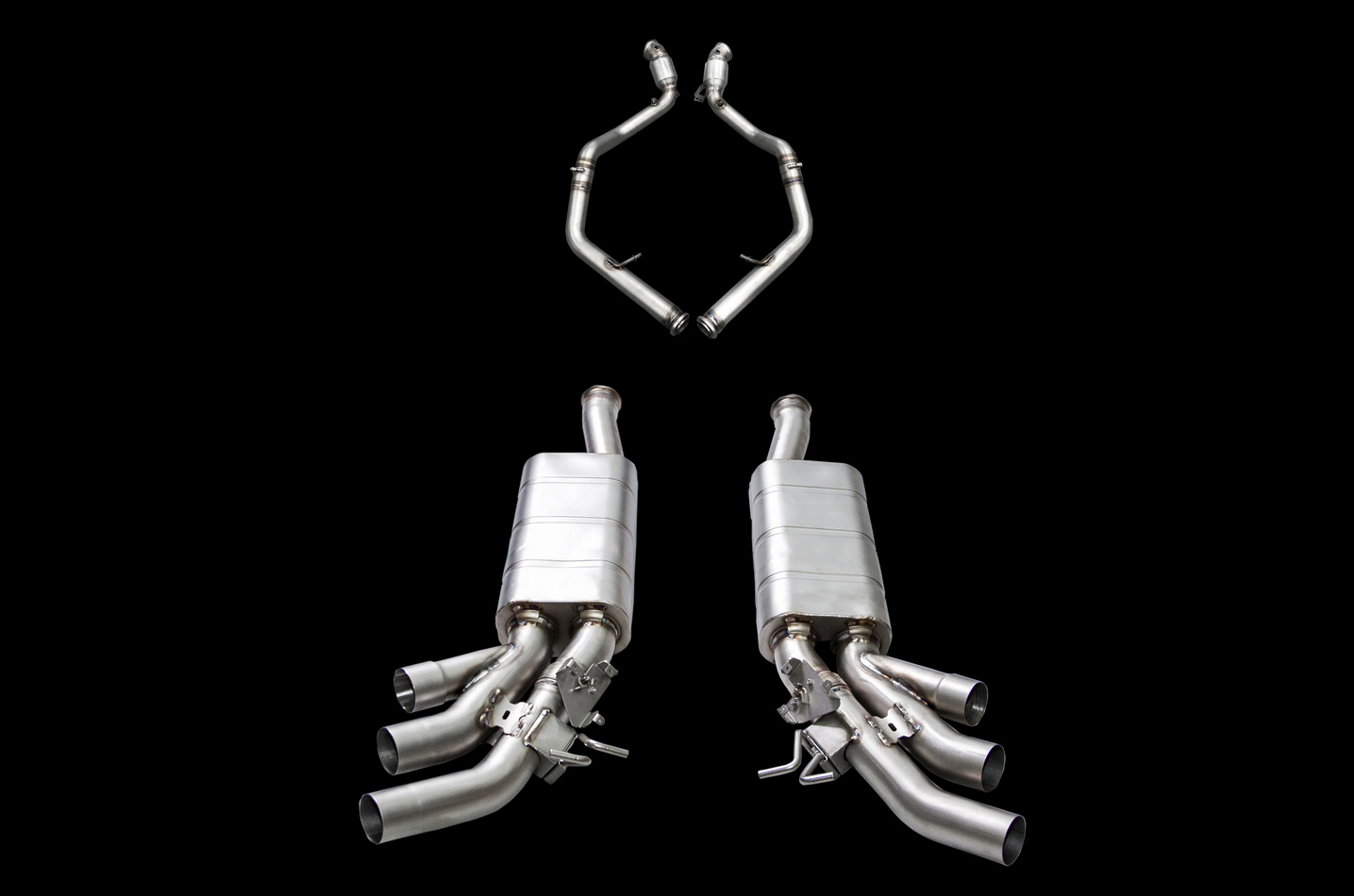

Mercedes G63 5.5L V8 BiTurbo AMG (W 463, 2012) Valved Mufflers with

California has very specific rules pertaining to depreciation and limits any Section 179 to $25,000 Maximum per year. So for example, if you purchase a vehicle for $125,000, you can write off $25, 000 as Section 179 in first year and remaining amount of $100,000 in this example has to be spread over 5 year period.

GPOWER releases tuned MercedesAMG G63

Detailed specs and features for the 2022 Mercedes-Benz G-Class AMG® G 63 including dimensions, horsepower, engine, capacity, fuel economy, transmission, engine type, cylinders, drivetrain and more.

MercedesAMG G63 po tuningu PerfomMaster 3,9 sekundy do setki, ponad

The deduction limit in 2021 is $1,050,000. For example, let's say you spent $20,000 on a new car for your business in June 2021. You use the car for business purposes 75% of the time. If you were to claim the Section 179 deduction, you could take a $15,000 deduction ($20,000 × 0.75) on your 2021 tax return, which you'd file in early 2022.

MercedesBenz G63 AMG 6×6 by Mansory (With images) Best suv cars

Any vehicle with a manufacturer's gross vehicle weight rating (GVWR) under 6,000 pounds (3 tons). This includes many passenger cars, crossover SUVs, and small utility trucks. For 2023, these autos have a Section 179 tax deduction limit of $12,200 in the first year they are used.

IPE exhaust system for MercedesBenz G63 / G500 (W464) Buy with

Qualifies as a tax write off in one year. Other vehicles qualify as a tax write off, but they need to be written off over several years. Also, if you look at similar competing cars, the only other one that's also over 6,000 lbs is a Range Rover, which is why they're basically the second most popular.

2019 MercedesAMG G63 Review Hits The Spot

6 Business meals, including pricey ones at places like Le Bernardin (above), where a chef's tasting menu can cost up to $440, can now be fully counted off — a government gesture to try to juice.

Mercedes G63 6x6 BRABUS 700 Luxury Pulse Cars Germany For sale on

If your vehicle has a gross weight (GVWR) above 6,000 pounds but below 14,000 pounds, you're eligible for a $26,200 write-off if placed in service in 2021. But if the vehicle is 100% business use and is qualified for bonus depreciation under section 179, a complete write-off is possible says, Dennis.

Het Automeisje & Gklasse 6x6 Mercedes g class, Mercedes, Mercedes g

Section 179 requires profit in the business, bonus depreciation does not. Possible, by the letter of the law, you could buy a vehicle December 31st, use it 100% business use that year and claim bonus depreciation. January first it could transition to personal use with no recapture.

MercedesBenz G63 AMG (2013) picture 7 of 105

Lastly, we will cover more on the weight tax and if this vehicle is falling under this category. So, if you want to learn more, follow along.. The average fuel economy in combined conditions is 14.4 MPG for the G55 and 13.8 MPG for the G63. Mercedes G Wagon Price. And when it comes to the G wagon the tax write-off is really a lot. About.

مرسيدس بنز G63 AMG معدلة بقوة 800 حصان

If you are looking to purchase a luxury vehicle for your business and are looking for a tax write-off, make sure to do it like a true tax professional. There are two ways to write off.