Michigan Gas Tax 2023

State and federal fuel tax collections could drop by $67 billion over that span. Michigan and 30 others states have so far responded by imposing new fees on electric or hybrid vehicles. For 2022, EV owners in Michigan are required to pay an extra $140 fee atop of their normal vehicle registration fees. Plug-in hybrid owners pay an extra $50.

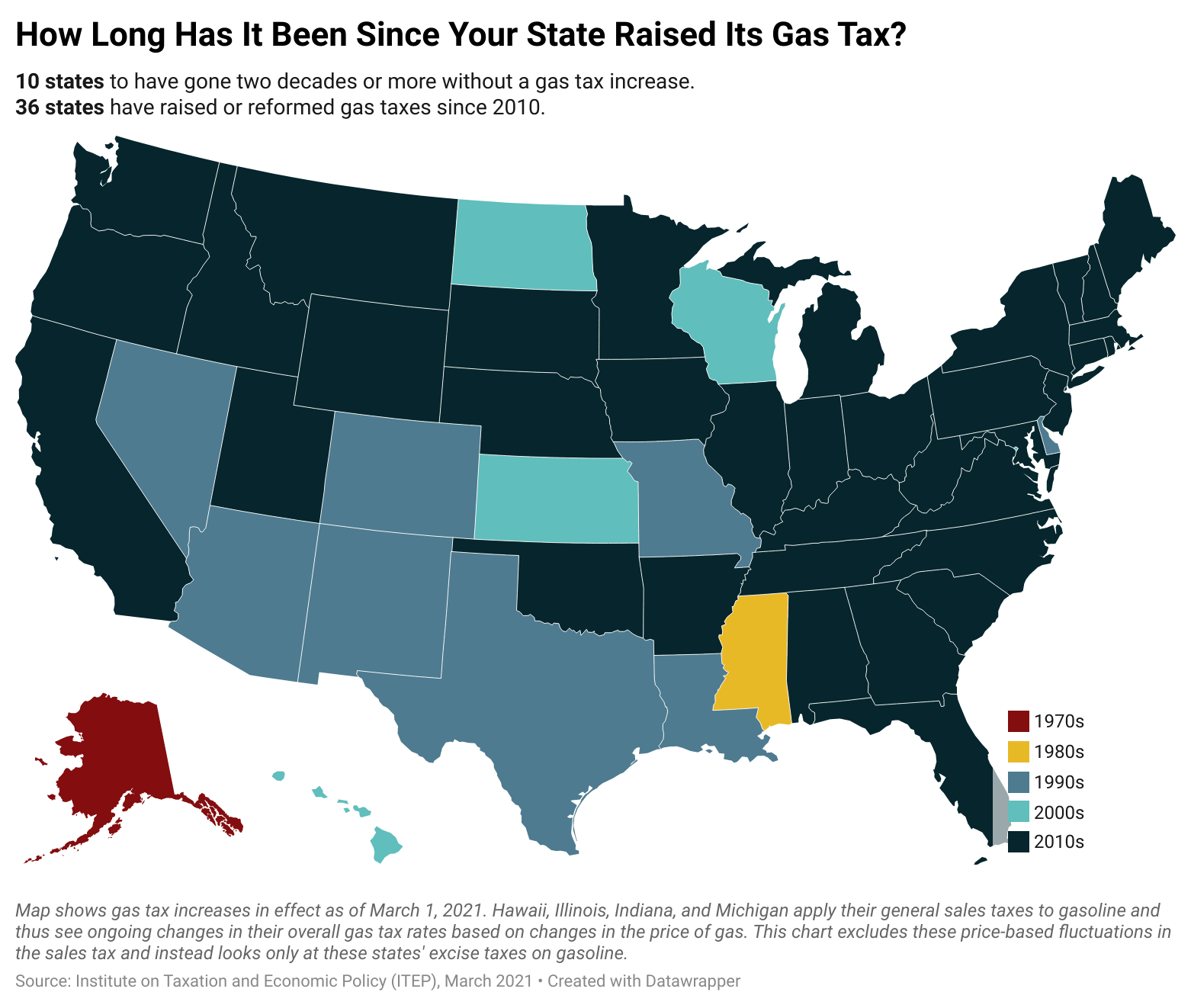

Most States Have Raised Gas Taxes in Recent Years ITEP

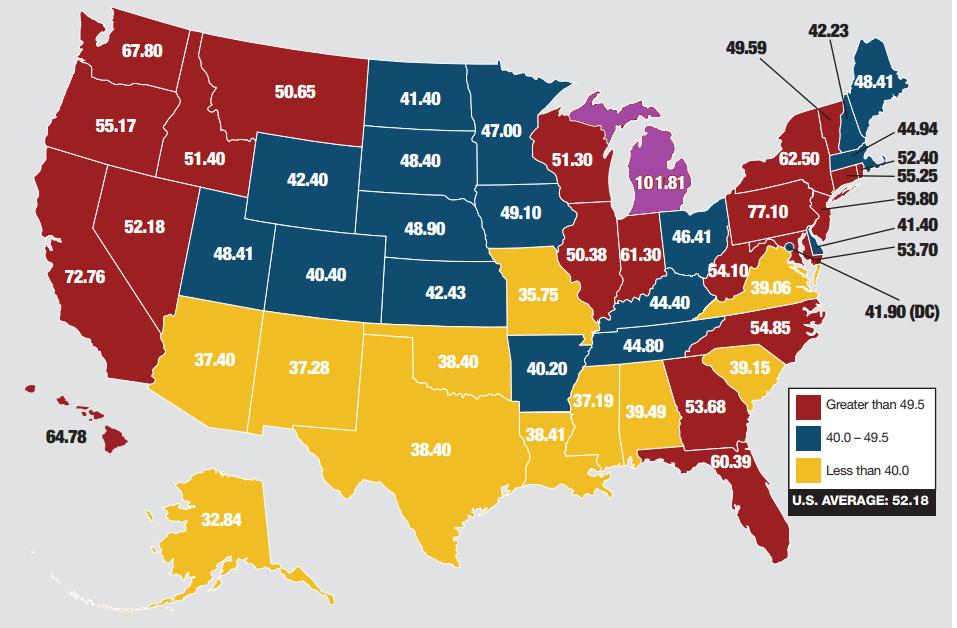

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg). The lowest state gas tax rates can be found in Alaska at 9.0 cents per gallon, followed by Missouri (17.5 cpg) and Mississippi (18.4 cpg). While few taxpayers cheer fuel taxes, these systems work well.

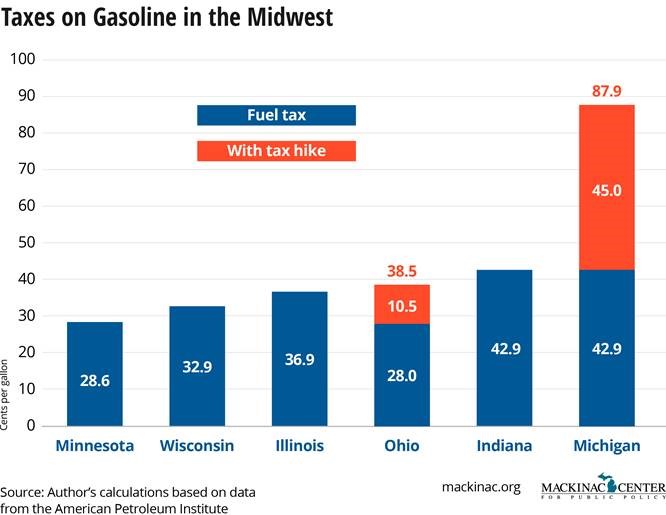

We’re No. 1? Michigan Could Get Nation’s Highest Gas Tax Michigan Capitol Confidential

0:03. 1:46. Michigan Republican and Democratic senators are pushing ahead with a series of new bills that would create a temporary summer tax pause when it comes to buying fuel. The bills pause.

michigan gas tax increase 2021 Supereminent Newsletter Navigateur

A law signed under former Michigan Governor Rick Snyder increased Michigan's gas tax from 27.2 cents a gallon to 28.6 cents. The rate increase is either 5% each year or the rate of inflation.

Gas Tax Rates, 2019 2019 State Fuel Excise Taxes Tax Foundation

Effective April 1, 2024 through April 30, 2024 the new prepaid sales tax rate for: Gasoline is 16.3 cents per gallon. Diesel is 20.9 cents per gallon. View the Current Notice of Prepaid Sales Tax Rates on Fuel.

Gas Tax By State Map World Of Light Map

The state excise tax is 7.5 cpg on (gas and diesel), additional 13.8 ppg state sales tax on diesel, 11.8 ppg state sales tax on gasoline. Gas and Diesel Tax rates are rate + local sales tax (varies by county and city, charged in PPG), "Other Taxes" include a 0.75 cpg UST (gasoline and diesel) Hawaii: 17: 17: 0.1191

Chart 12 U.S. States Are Boosting Their Gasoline Tax Today Statista

Michigan Business Tax 2019 MBT Forms 2020 MBT Forms 2021 Michigan Business Tax Forms 2022 Michigan Business Tax Forms. Gasoline $.30 per gallon; Diesel Fuel $.30 per gallon; Alternative Fuel (which includes LPG) $.30 per gallon; January 1, 2023 Through December 31, 2023.

Michigan gas tax increase begins in 2017 YouTube

That requires 40 gallons of gas each month, which is a tax amount of about $11.50 monthly at Michigan's tax rate. You pay $11.50 to the government in Michigan to use all the roads. Seems cheap. If the mileage fee is 1.15 cents per mile, you would still pay $11.50 per month.

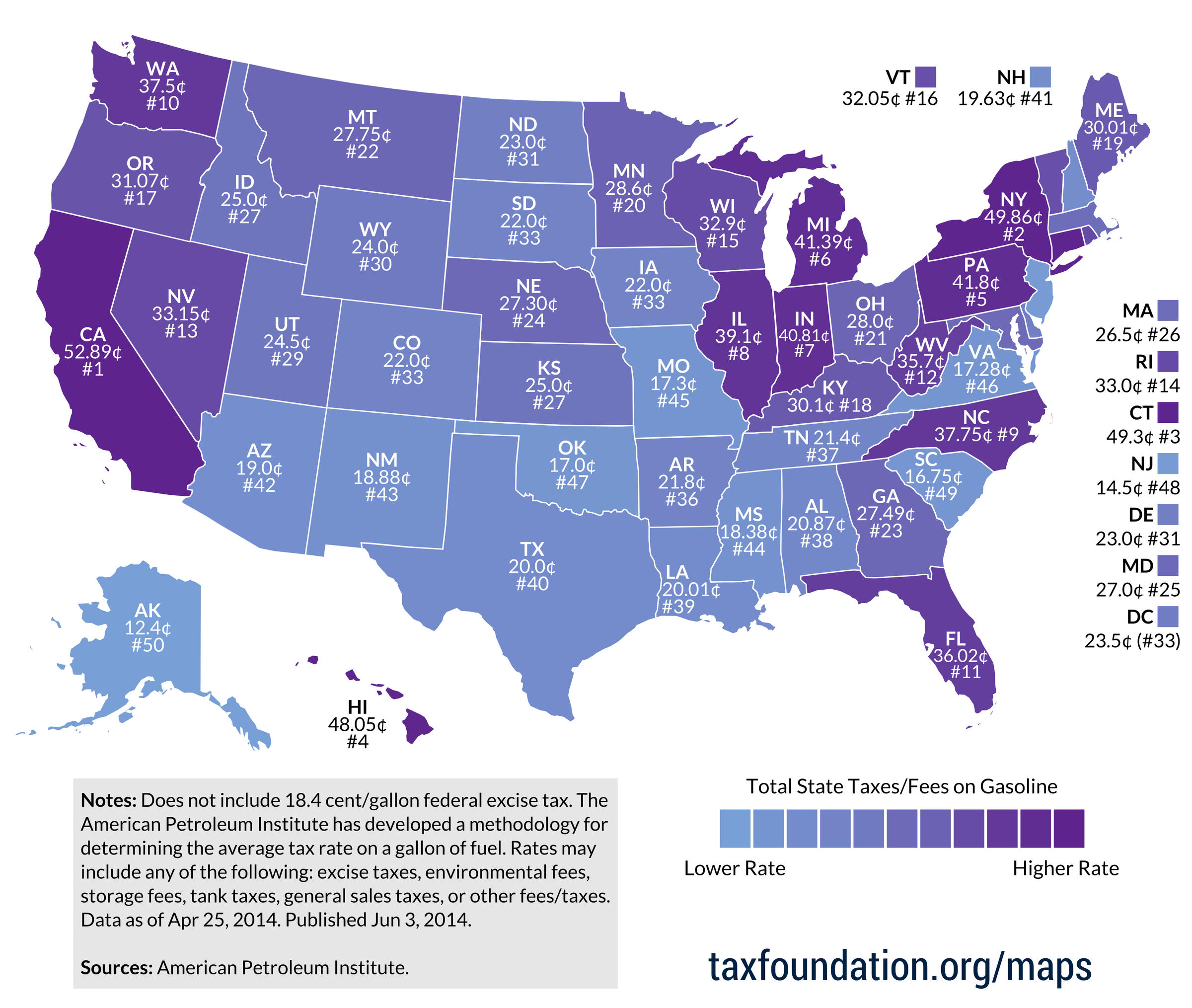

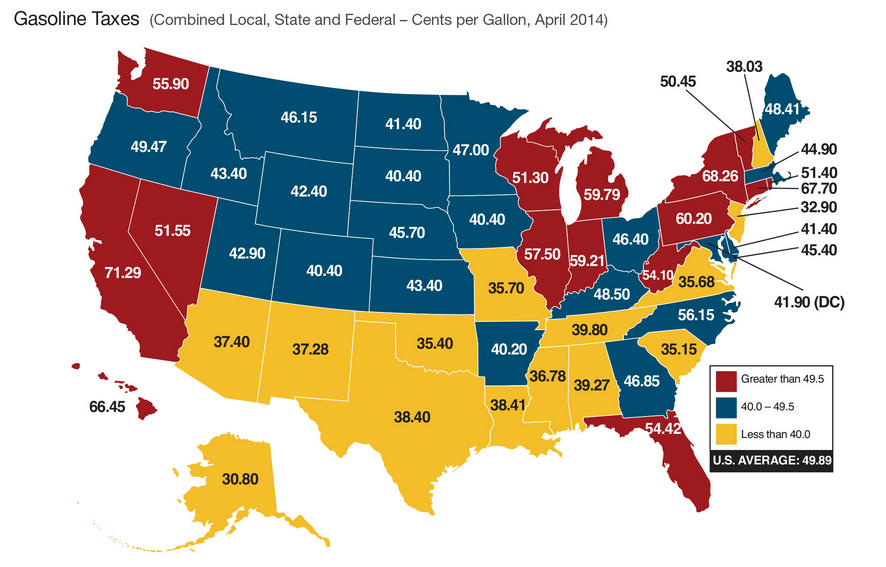

How Gas Taxes in Michigan Compare to Other States

A summer suspension of Michigan fuel taxes passed the state Senate Thursday. Speaking ahead of voting on the legislation, State Senator Roger Victory (R-Hudsonville) said pausing the gas tax is necessary as prices soar. "While state government is seeking historic budget surpluses, Michigan family budgets are being stretched thin," Victory said.

4 things to know about gas prices in Michigan Michigan Radio

Michigan's total gas tax — the 27-cent excise tax and the 6% sales tax — was the 11th highest in the nation in 2021, behind states such as California, Hawaii, Illinois and Nevada, according to.

Five States Pass Major Gas Tax Increases MultiState

LANSING—As gasoline prices hit record highs nationwide, Michigan leaders are pushing for gasoline tax relief — but differ on how the state should offer it. Michigan House lawmakers approved a Republican-backed plan 63-39 Wednesday to suspend the state's $27.2 cent-per-gallon gas tax for six months — a move aimed to provide tax relief.

michigan gas tax increase 2021 Supereminent Newsletter Navigateur

In 2016, Michigan's gas tax was 19 cents per gallon, but has been raised to provide more funding for roads and infrastructure. When combining state gas and sales taxes plus the 18.4-cent federal.

Higher gas tax starts in Michigan, Indiana considering Business

How much tax is on a gallon of gas in Michigan? On January 1, 2022, Michigan drivers started paying a tax of a little more than 27 cents per gallon for the state motor tax (aka gas tax). AAA.

Would You Rather Have Higher Gas Tax or Toll Roads In Michigan?

FLINT, Mich. (WJRT) - With electric vehicle usage on the rise, the Michigan Department of Transportation is exploring new options to replace the gas tax. The state plans to spend $5 million on a.

Gas Tax Rates by State, 2021 State Gas Taxes Tax Foundation

Getting gas can be pricy depending on the vehicle and oil market, but in Michigan, drivers could be forced to shell out more at the station if a current gas tax increase proposal is implemented.

What goes into the cost of a gallon of gas in Michigan? Michigan Radio

Should Michigan change or get rid of the gas tax? The Michigan Department of Transportation is asking for the public's input. Now through March 1, Michigan residents can weigh in on the way we all.