IEPA opens Electric Vehicle Rebate Program for Illinois Residents

Illinois Illinois electric vehicle rebates, tax credits and other incentives Use this tool to find Illinois tax credits, incentives and rebates that may apply to your purchase or.

Electric Vehicle Rebate Now Available For Illinois Residents

Illinois is set to begin offering rebates of up to $4,000 to residents who buy new or used electric vehicles starting July 1. The $4,000 rebate will be available through 2026, or as long as funds.

Illinois Electric Vehicle Trends & Statistics to Know

We want to have a million electric vehicles on the road by 2030, and we are attacking that from all ends," Mitchell says. "On the cost side. we're providing a $4,000 incentive for consumers to go out and buy an electric vehicle." Combined with federal tax credits, that can lower the price of an electric vehicle by more than $10,000.

Illinois Electric Vehicle Incentives VEHICLE UOI

Which vehicles are eligible? In order to qualify for the rebate, the all-electric vehicle — no plug-in hybrids allowed — must be bought in Illinois and the application must be submitted.

Illinois Utility Map

Fleets with 10 or more vehicles located in defined areas of the state must pay an annual fee of $20 per vehicle in addition to registration fees. Owners of electric vehicles are exempt from this fee. The Office of the Illinois Secretary of State deposits all fees into the Electric Vehicle Rebate Fund. (Reference Illinois Compiled Statutes 120/35)

Illinois’ electric vehicle goal 1 million by 2030 WBEZ Chicago

The passage of the state's Reimagining Electric Vehicles (REV) Act and Climate and Equitable Jobs Act in 2021 has ushered in a new era of opportunity in Illinois. Simply put, we are making the necessary investments to be the best state in the nation to manufacture or drive an electric vehicle.

Illinois electric vehicle rebate State launches EV program to

The Illinois EPA has been appropriated $12 million for the current fiscal year, which ends on June 30, 2024. Actual funding amounts will be determined by the amount of money available in the Electric Vehicle Rebate Fund not to exceed $12 million. Eligibility What are the eligibility requirements for the rebate?

How much are stickers for license plates in illinois frenzymusli

Purchase a new or used all-electric vehicle within the state lines. To qualify for the full rebate, the vehicle purchase date must be purchased before June 30, 2026. Between July 1, 2026, and June 30, 2027, the rebate drops to $2,000. After July 1, 2028, the rebate drops to $1,500,

Electric vehicle startup to begin manufacturing in Illinois

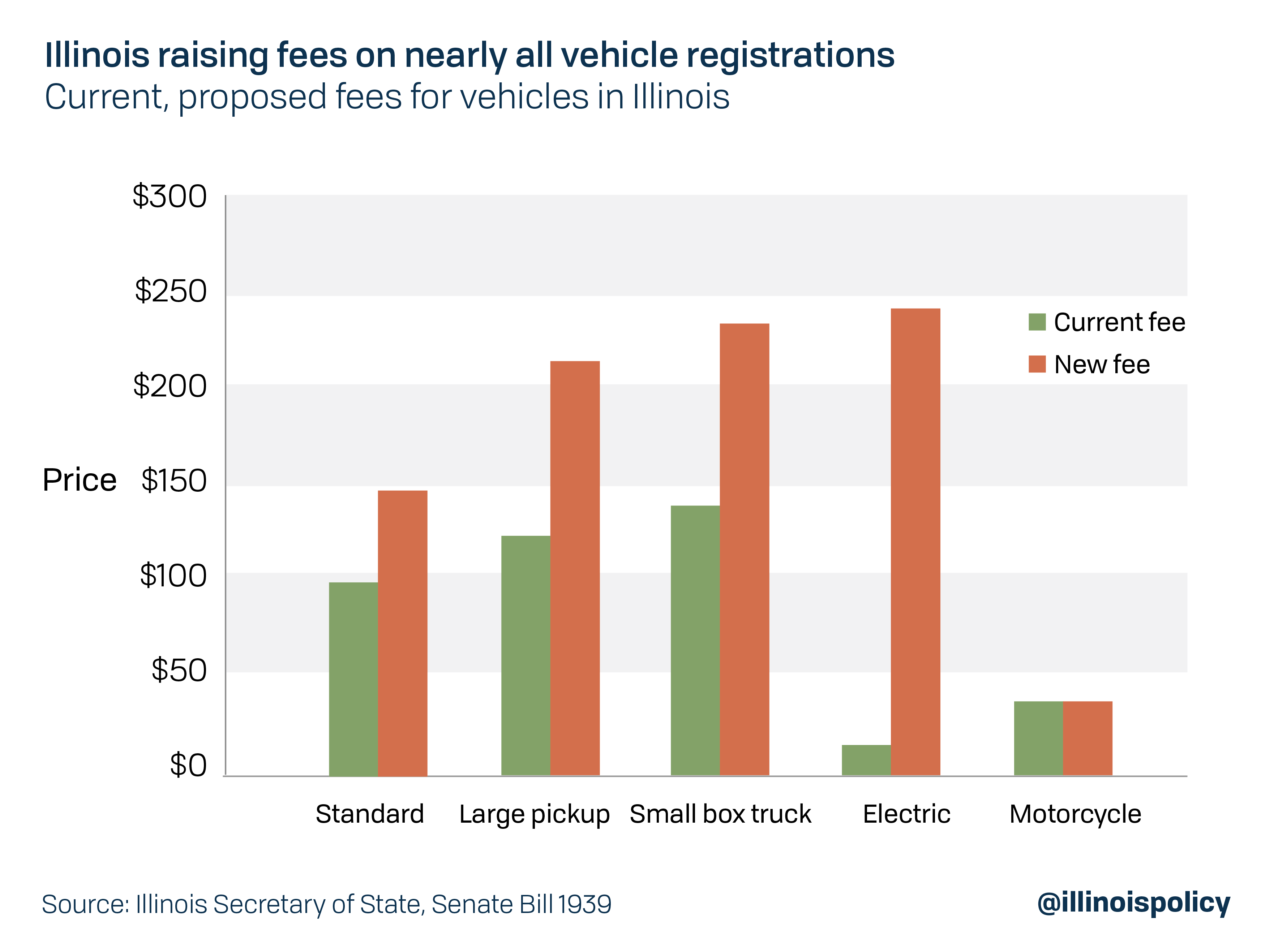

Illinois charges an annual tax of $100 for electric vehicles, added on to the regular registration renewal fee. What Other EV Incentives Can I Get in Illinois? Electric vehicles.

Illinois Electric Vehicle Rebate PaymentGrant (Refund Cheque) Funny

The Illinois General Assembly has appropriated $12 million to Illinois EPA for the current fiscal year, which ends on June 30, 2024. Actual funding amounts will be determined by the amount of money available in the Electric Vehicle Rebate Fund, not to exceed $12 million. REBATE APPLICATION

Electric vehicle rebate program available for Illinois residents Eagle102

The REV Illinois program is specifically designed to help create new jobs in the cutting-edge EV and renewables industries, to pave the way for investment in priority areas, and to incentivize employers to provide ongoing skills training in this field.

Electric Car Credit Limit How The Electric Car Tax Credit Works

Find the deal you deserve on eBay. Discover discounts from sellers across the globe. Try the eBay way-getting what you want doesn't have to be a splurge. Browse top items!

Illinois Electric Vehicle Rebate Program now open

Individuals must be an Illinois resident, must purchase an all-electric passenger vehicle from a dealer licensed by the Illinois Secretary of State that hasn't previously been the subject of this EV rebate, and must purchase the vehicle after July 1, 2022. (Link to Application) EV Charger Incentives & Rebates in Illinois EV Charger Rebate

2021 Illinois Electric Vehicle 22620EL Cool IL Plates

Only all-electric vehicles from licensed Illinois dealers are eligible.

Illinois Electric Vehicle Counts by County Atlas EV Hub

The Reimagine Electric Vehicles (REV) in Illinois Act will help make Illinois the best state in the nation to manufacture an EV and create thousands of jobs. EV manufacturer's looking to move to or expand operations in Illinois will benefit from the incentives offered by the REV Act. Who is Eligible? Large EV Businesses

Signs to mark Illinois electricvehicle stations

Income requirements: The credit is available to those whose taxable income is below the following thresholds: Single filers - $150,000; Joint filers - $300,000; and Heads of household - $225,000. Vehicle price requirements: Individuals don't qualify for the tax break if their van, sport utility vehicle or pickup truck costs more than $80,000.