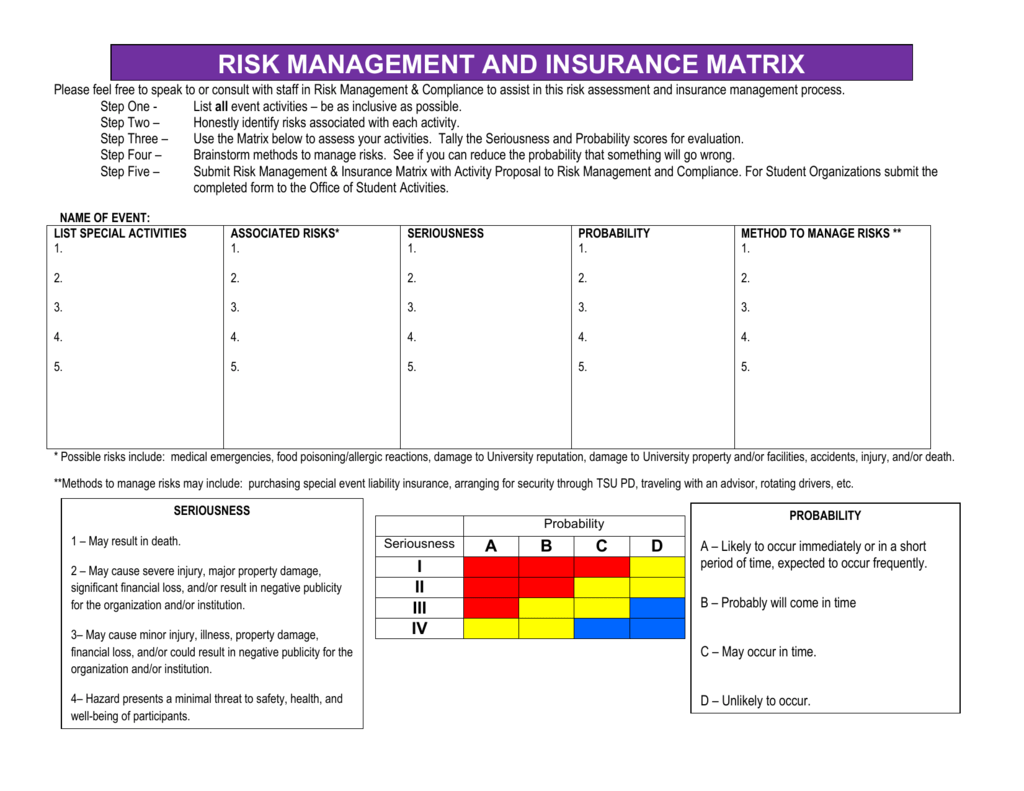

risk management and insurance matrix

Risk assessment is a general term used across many industries to determine the likelihood of loss on a particular asset, investment or loan. The process of assessing risk helps to determine if an.

Sample Risk Management Checklist Template

The risk assessment measures various risks and helps an insurance company define the most significant ones. Enterprise risk management (ERM) for insurance companies means monitoring and updating controls for mitigated or accepted risks, as well as making a decision to transfer risk via cyber insurance .

Do You Know What You Don’t Know? Cybersecurity

A few years back, we created our Insurance and Risk Management Checklist to outline steps companies should take to evaluate their insurance and risk management programs, and to plan for the year ahead. Now more than ever, it is vital for companies to stay on top of these critical functions. Last year saw a rise in weather-related and other.

Risk Register Excel Template Free Of Risk Register Template Download as Excel by Maclaren1

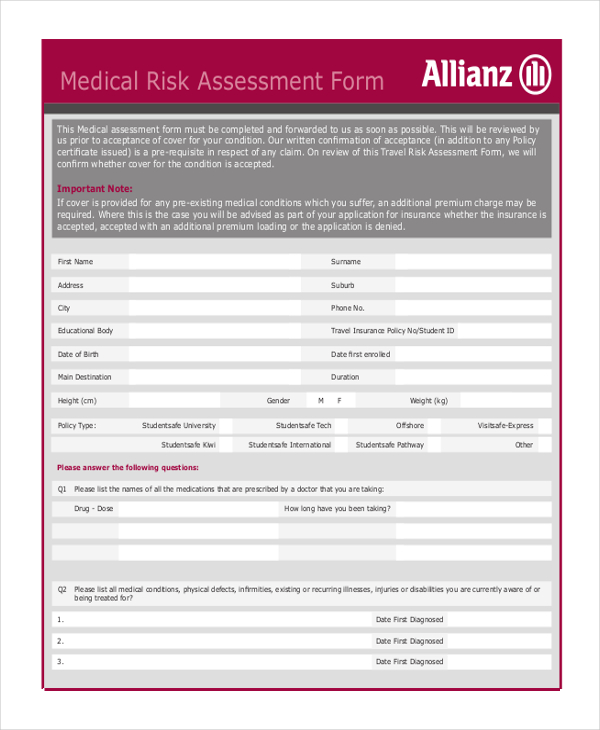

Insurance questionnaires are more than just formalities; they're essential risk assessment tools for insurers. Inaccurate or incomplete answers can lead to denied coverage, significant financial penalties, and even legal repercussions. Navigating compliance demands clear, comprehensive information that leaves no room for ambiguity.

Insurance Risk Assessment Questionnaire ABINSURA

Revised our industry risk assessment on the global protection and indemnity (P&I) insurance sector to high, from moderately high. This is mainly due to our forecast of weak profitability prospects for the sector in 2021-2022, together with its poor operating performance track record. In 2019-2020, the sector's combined ratio was well above 100%.

(PDF) SURVEY OF MSME INSURANCE RISK ASSESSMENT TECHNIQUES

Performing Individual Risk Assessments 6.1 General. This section focuses on individual risk assessments, both the preparation for, and the execution of these risk assessments. Depending on the scope of the assessment, not all provisions in this section are applicable to all risk assessments.. Risk and Insurance Management Society, Inc. All.

insurance risk assessment template YouTube

These reforms were designed to increase the number of individuals covered by health insurance, create insurance coverage that was both comprehensive and affordable, and ensure minimum levels of coverage. Risk Assessment _ referred to risk assessment _ as the first stage of the process to estimate the risk, and referred to.

Risk Management In Insurance Risk Management And Insurance Career Profession Job Opportunities

The risk and compliance functions are expected not only to go on protecting insurance companies from downside risks but also to shift toward providing them with strategic advice to support growth (for instance, new business) and change (such as company-wide cost and tech transformations). At the same time, the risk and compliance functions need.

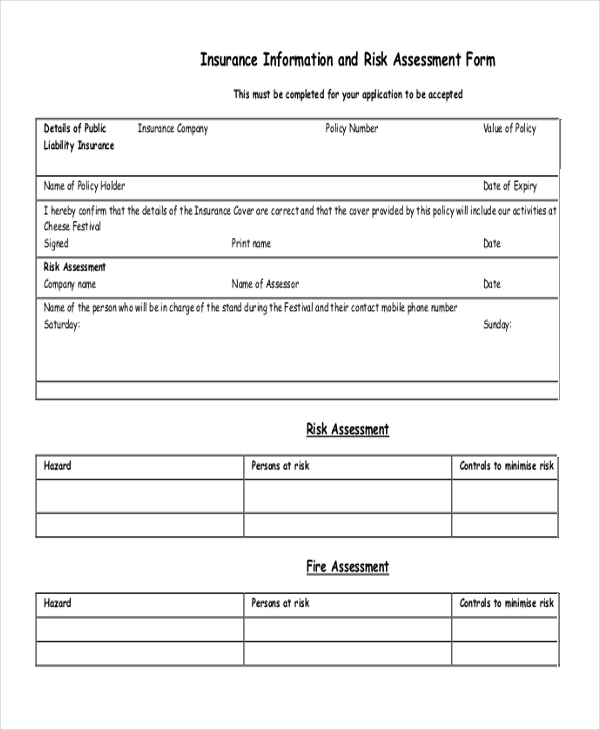

FREE 9+ Sample Insurance Assessment Forms in PDF Excel MS Word

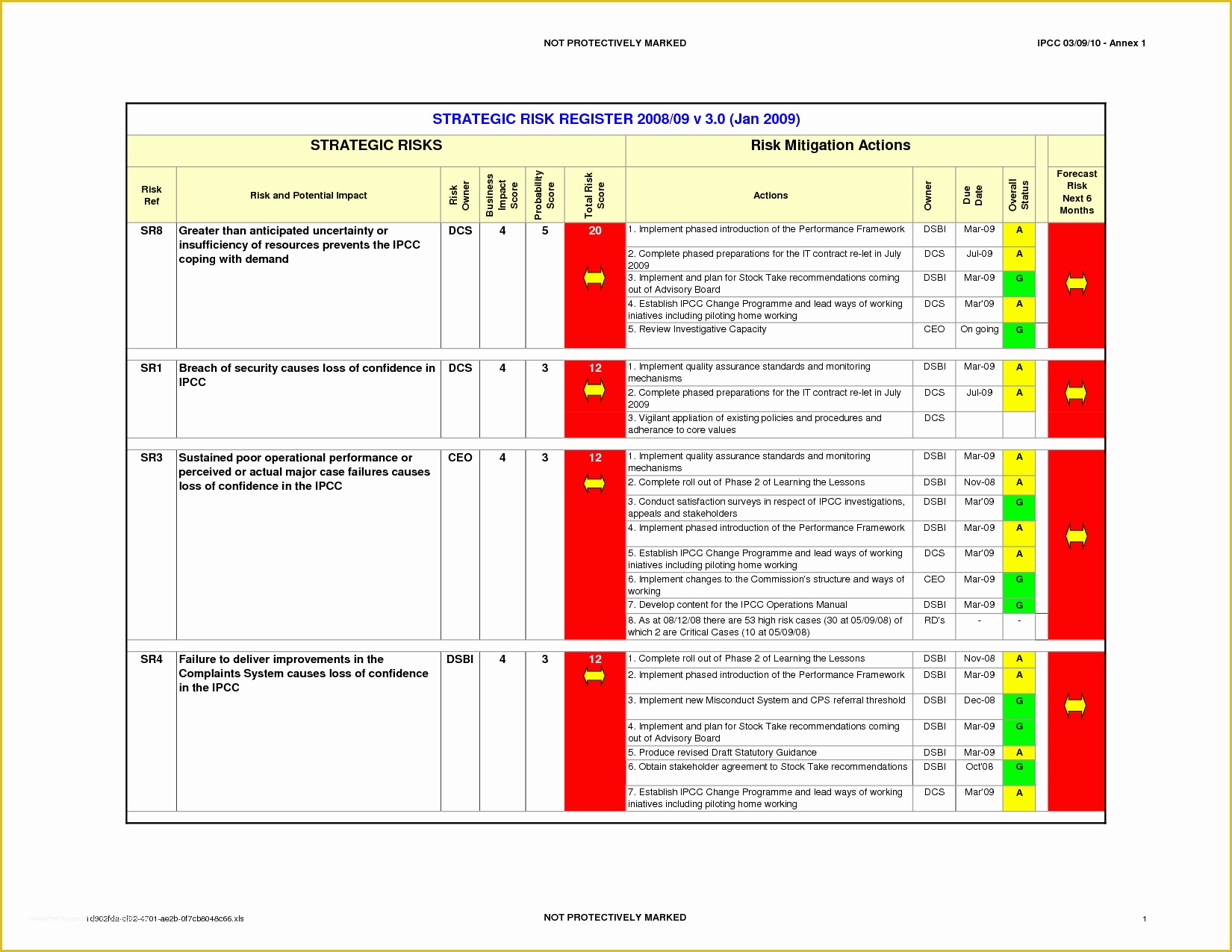

Issue: Enterprise risk management (ERM) has attracted much attention in the last several years, particularly following the great global financial crisis. In today's uncertain world of complex and interrelated risks, an increasing number of financial institutions, including insurance companies, have implemented or are developing an ERM system.

Risk Assessment In The Insurance Industry

Risk Measurement in Insurance use of risk measurement for both capital and other more abstract risk based decision support challenges will be considered as part of the evaluation of the various methods discussed in this paper. To maximise the decision support provided, the risk quantification will need to satisfy a number of requirements:

Insurance Risk Assessment Using Predictive Analytics

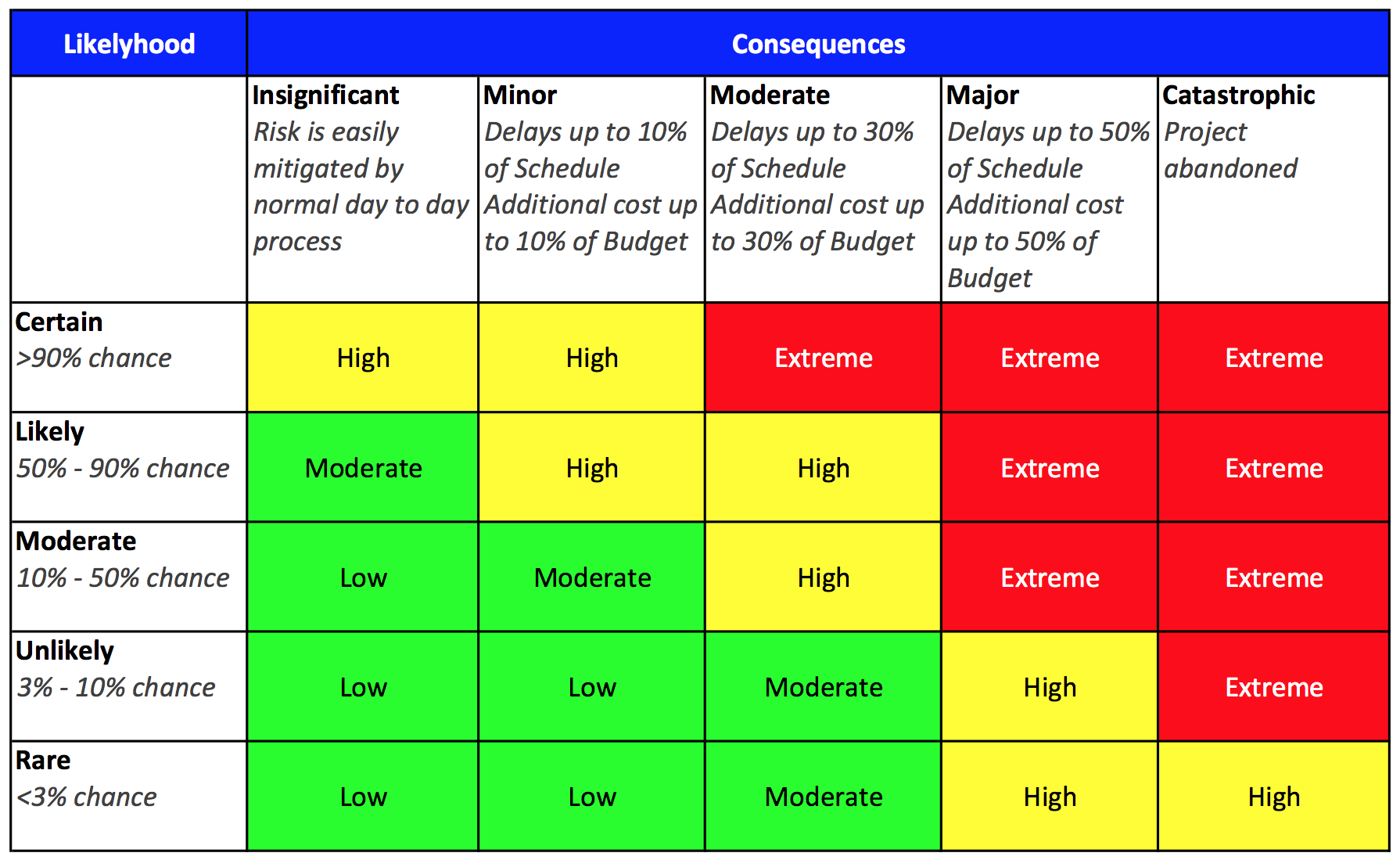

A risk assessment determines the likelihood, consequences and tolerances of possible incidents. "Risk assessment is an inherent part of a broader risk management strategy to introduce control measures to eliminate or reduce any potential risk- related consequences." 1 The main purpose of risk assessment is to avoid negative consequences related to risk or to evaluate possible opportunities.

Risk Assessment Scorecard Wells Insurance

Risk management involves identifying, assessing, and mitigating risk. The beauty of a well-implemented risk management program is that it's built on a foundation of standardized risk assessments to help companies prioritize their risk based on its potential impact. Naturally, this process will surface risks that will impact the business's.

It Risk assessment Template New 2 6 Risk assessment Report Report template, Assessment

When an insurer issues an insurance contract, it agrees to assume the risks described in the policy in exchange for a premium. Insurers make money by taking advantage of two statistical concepts: risk pooling and the law of large numbers. Insurers pool risks by accepting a large number of policyholders that have a low risk of incurring losses.

Risk Assessment Checklist Template

The CoreLogic® Wildfire Risk Score is a crucial tool that enables underwriters to easily distinguish areas of exceedingly high- and low-wildfire risk. The risk score is also valuable for actuaries who can use the score to better assess a home's value. The CoreLogic Wildfire Risk Score is an easy-to-use, comprehensive, 5-100 score that.

Risk assessment ATE insurance Temple Legal Protection

Traditionally insurance models have relied on historical loss and exposure data, and sometimes reflect just the last one or two decades when it comes to financial markets. However, real-world risk dynamics are forever changing. To improve the basis of sustainable underwriting and investment decision-making, a modelled risk needs to reflect both.

Insurance Risk Assessment Template Understanding The Background Of Insurance Risk Assessment

Insurance Risk Class: A group of individuals or companies that have similar characteristics which is used to determine the risk associated with underwriting a new policy and the premium that.