Leasing vs. Buying a Car Best LongTerm Option? CentSai

You must list Tesla Lease Trust as the lienholder and an additional insured party on the policy. Tesla Lease Trust 12832 Frontrunner Boulevard Suite 100 Draper, UT 84020. Note: Your lease comes with gap protection. For vehicles leased with a third-party lessor, refer to your lessor for insurance requirements.

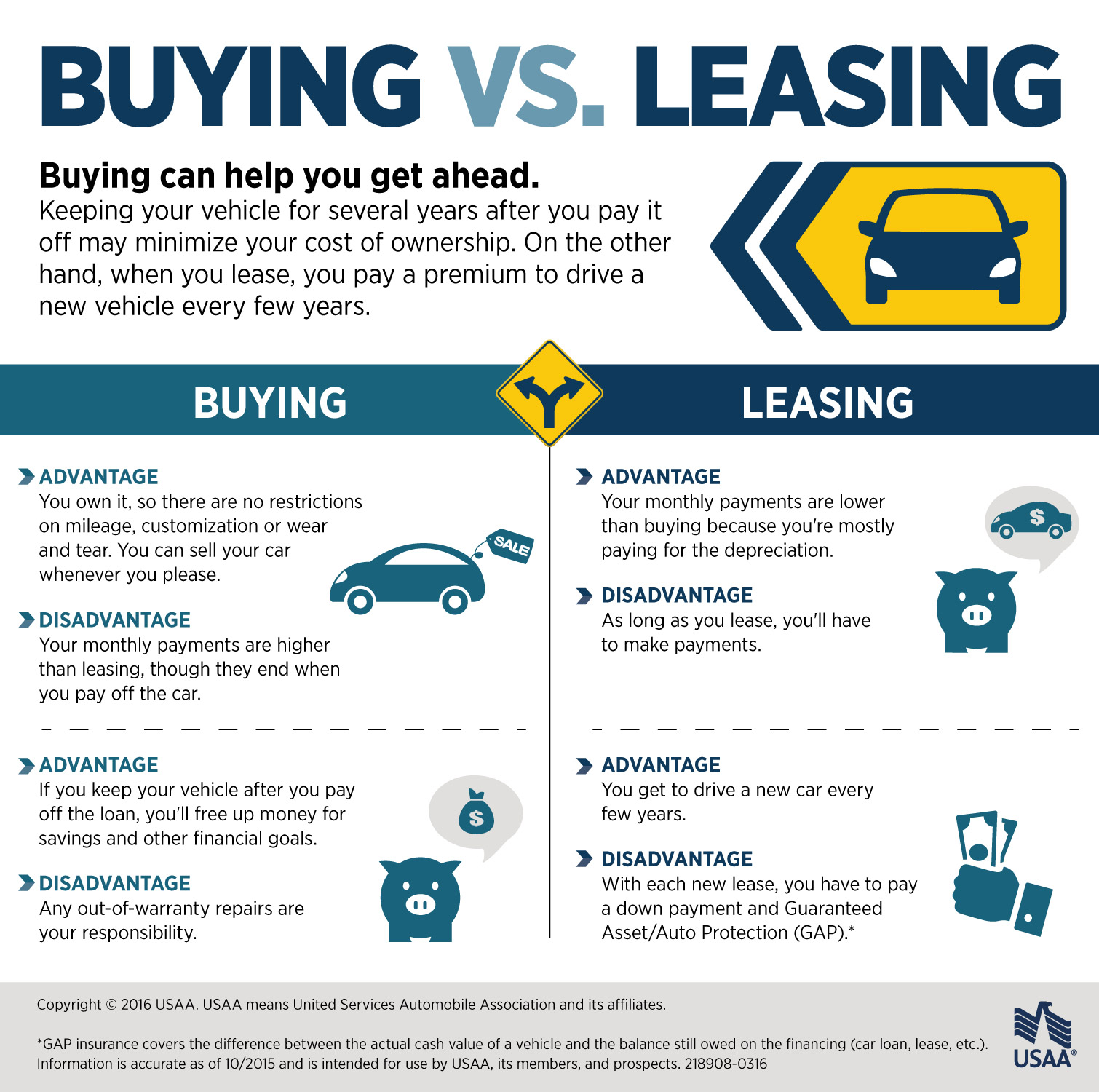

Pros and Cons of Leasing or Buying a Car

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Financing tends to be more common than leasing because of one key factor - ownership. Once your auto loan is paid off, you'll own the vehicle outright and don't have to worry about making any.

Differences between buying, leasing a car Business Insider

This results in a total amount of $41,190. Chances are you'll lease or take out a loan instead unless you've been saving up for a Tesla in advance. Tesla estimates that a $4,500 down payment and a 72-month loan period would cost $549 a month at a 2.49% APR.

The Truth about Leasing vs Buying Part 1 The Fundamentals

Tesla is leasing the Model Y for $489 per month with the same $4,500 down. The lease runs for 36 months and only allows for 10,000 miles per year. However, a monthly payment of less than $500 is.

Leasing vs. Buying a Car Car buying, New cars, Lease

Yes the market is out of wack and yes a Tesla leased car could be worth more than the buyout but this is partially due to the insane used car market but this should correct and with Tesla bringing back leased cars this also correct the used car worths. so. im leasing one myself. I've done the math and all.

Tesla’s Leasing Partner Isn't Doing So Hot Report

For instance, Tesla slashed the price of the Model X SUV by a total of $41,000 so far in 2023, and Ford dropped the price of the F-150 Lightning electric pickup truck by nearly $10,000 in July.

PPT Leasing vs. Buying PowerPoint Presentation, free download ID3535013

Tesla Model 3 lease. To begin, leasing prices for a 2021 Tesla Model 3 Standard Range Plus are $409 monthly for 36 months, at 10,000 miles per year, with $5,604 down (including acquisition fee.

When To Leasing A Car Vs Buying In 2022 • Throttlebias

It appears that the residual value is crazy strong meaning the lease should be much cheaper. Our current lease on my wife's Tacoma was $14,500 for 39 months and 39K miles, the Tesla with a similar capitalized cost shows a stronger residual value but that lease costs $6K more for 36 months and 30K miles.

Leasing vs. Buying a Car Burns Ford of Lancaster Blog

In current market conditions, tax credits and extensive 8-year, 100,000-mile warranties sway much of the driving public toward electric cars. Yet when the powers that be closed part of the Tesla lease vs. buy discussion by removing lease buyouts from consumer agreements, many prospective buyers opted to lease first, then (potentially) buy. Even.

Pros and Cons of Leasing vs. Buying A Car

4. Buyers who drive a lot/cover more miles in a year/month. When financing a Tesla, you are not limited to the miles you cover on your Tesla, considering how fun it is to drive it. That said, you can cover as many miles as you can compared to when you lease the car. This is because leasing has a cap on mileage/mileage limitation, and you could.

Leasing vs Buying a Car Infographic USAA

Tesla does not publish its minimum credit score requirements. However, Tesla offers lease terms of 24 and 36 months, depending on your chosen model. Most Model 3 and Model Y variants come with 36-month terms, while you can lease Model S and X variants for 24 or 36 months. If you're wondering if you should lease and then buy a Tesla, your.

Leasing vs Buying a Solar Energy System

Buy vs Lease a Tesla. When you purchase a Tesla vehicle, you obtain ownership of the car. When you buy through Tesla, you can participate in one of their financing programs or utilize your financial institution to finalize the sale. Like leasing, you can customize your Tesla to match the color and features you want in a vehicle.

Buying vs Leasing a Car Infographic Plaza

The Tesla Model S, X and 3 depreciate at 36.3%, 33.9% and 10.2%, respectively, over three years. It takes more than 50,000 miles of driving before the battery capacity drops by 5%. This means that buying a Tesla may be a more attractive option than leasing since it could hold its value better in the long run.

Valley Chevy Buying vs Leasing a Car Infographic Valley Chevy

Tesla is leasing the base Model 3 for just $389 per month for 36 months with $4,500 down.. you could need up paying $17,000 to $18,000 more by choosing to lease a Tesla rather than buy one. See.

Leasing vs. Buying Equipment Pros, Cons, & Considerations

Leasing vs. Owning a Tesla: 5 Must-Know Facts. The cost of owning a Tesla is a bit lower compared with other EV models. Teslas are more fuel-efficient and require less maintenance than gas-powered cars. Lessees won't have the car for long, whereas owners avoid costly upkeep costs.

Is Leasing a Tesla a Good Deal? What to Know. Barron's

Lease your vehicle You can lease a Tesla vehicle over the terms of 24 to 36 months. Leasing is only available to qualifying customers. Finance your vehicle You can purchase a Tesla vehicle by financing with a Tesla financier or a third-party financier over the terms of 36 to 84 months. Tesla Financing is only available to qualifying customers.