2023 luxury vehicle depreciation caps Archives Bailey Scarano

The IRS has issued the luxury car depreciation limits for business vehicles placed in service in 2023 and the lease inclusion amounts for business vehicles first leased in 2023. Luxury Passenger Car Depreciation Caps. The luxury car depreciation caps for a passenger car placed in service in 2023 limit annual depreciation deductions to: $12,200.

Ridiculous Luxury SUV Depreciation Can Save You Thousands

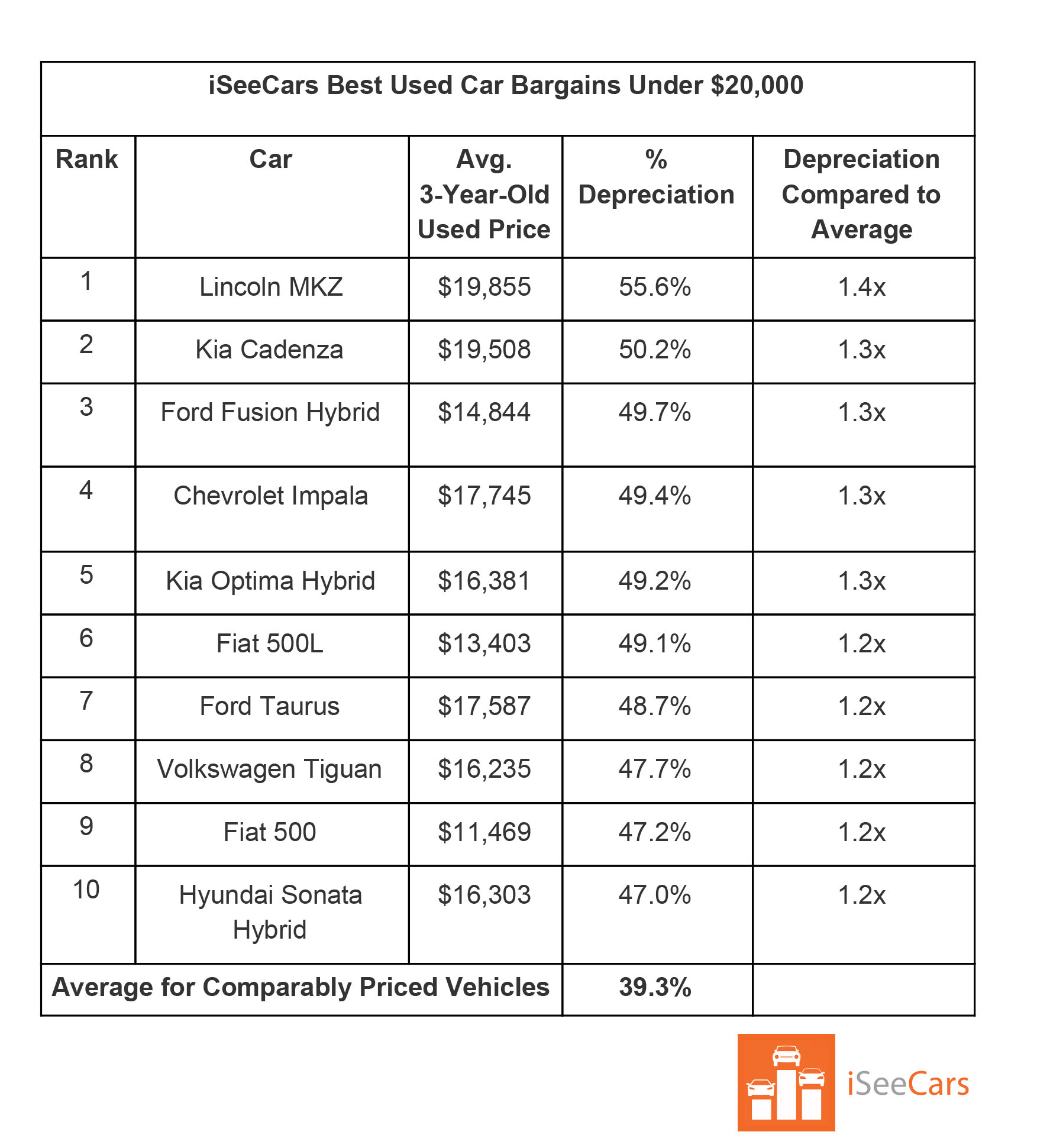

Infiniti QX60 - 50.2% View Gallery 19 Photos If you're surprised to see the QX60 on this list, we understand. After all, it hasn't been redesigned since the 2013 model year, and Infinitis don't.

Some Hidden Costs You Should Know Before Purchasing a Luxury Vehicle

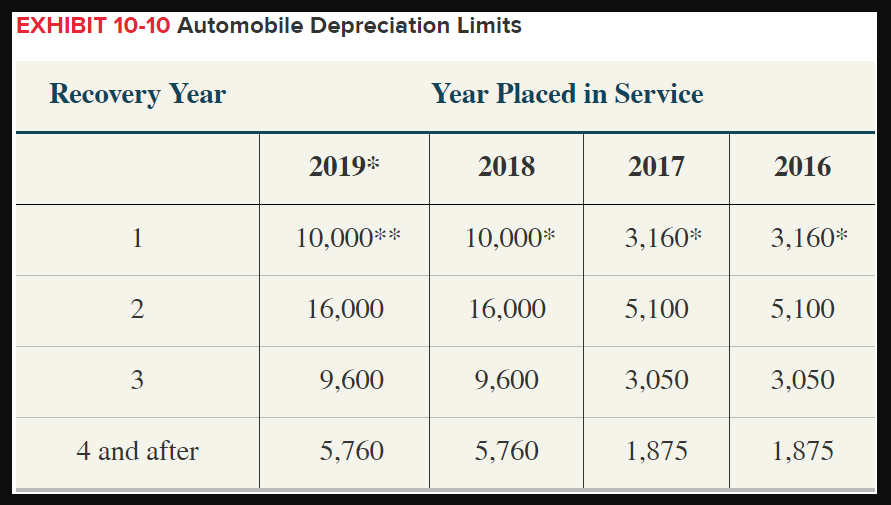

The limits for automobiles acquired before September 28, 2017, that qualify for bonus depreciation are: 1st tax year: $14,900. 2nd tax year: $16,100. 3rd tax year: $9,700. Each succeeding year: $5,760. The limits for autos acquired after September 27, 2017, that qualify for bonus depreciation are: 1st tax year: $18,100.

How Car Depreciation Affects Your Vehicle’s Value Credit Karma

The Basics For new and used passenger autos driven over 50% for business, the TCJA increased the so-called luxury auto depreciation limitations. For this purpose, passenger autos include cars and SUVs, trucks and vans with gross vehicle weight ratings (GVWRs) of 6,000 pounds or less. Annual inflation-adjusted allowances assume 100% business use.

Car Depreciation What Are the Risks? CRS Automotive Hamilton

2022 Luxury Auto Depreciation Limits, Tables and Explanations The tax law limits the amount you can deduct for depreciation of your car, truck or van. The section 179 deduction is also treated as depreciation for purposes of these limits. The maximum amount you can deduct each year depends on the year you place the car in service.

Luxury Cars Enjoy a Minimum Depreciation Rate

Share 2023 Luxury Auto Depreciation Limits, Tables and Explanations The tax law limits the amount you can deduct for depreciation of your car, truck or van. The section 179 deduction is also treated as depreciation for purposes of these limits. The maximum amount you can deduct each year depends on the year you place the car in service.

Which luxury cars hold their value best? [Infographic]

It's important to note that the designation "luxury vehicle" is used somewhat loosely by the IRS and is deemed to be a vehicle with four wheels used mainly on public motorways that must have.

Luxury Sedans And EVs Have Some Of The Worst Depreciation Rates Carscoops

Calculate the cost of owning a car new or used vehicle over the next 5 years. Edmunds True Cost to Own® (TCO®) takes depreciation. loan interest, taxes & fees, fuel, maintenance and repairs into.

Everything You Need To Know About Vehicle Depreciation Values

Tax depreciation is the recovery of the cost of property, such as a business vehicle, over a number of years. A portion of the cost is deducted every year until the taxpayer fully recovers the cost. However, when it comes to certain property, such as vehicles, there are special rules and limits for depreciation that must be considered.

Maserati Depreciation Comparison to other Luxury Vehicle Brands

Maserati: Maserati vehicles, known for their Italian craftsmanship and exhilarating performance, often suffer from significant depreciation. Factors such as high ownership costs, limited dealer network, and concerns over long-term reliability contribute to their faster depreciation. 3. BMW: BMW, a popular luxury brand, experiences relatively.

Automobile IMG Luxury Automobile Depreciation Limits

The depreciation caps for a luxury passenger car placed in service in 2022 are: $11,200 for the first year without bonus depreciation $19,200 for the first year with bonus depreciation $18,000 for the second year $10,800 for the third year $6,460 for the fourth through the sixth year SUV, Truck, and Van Depreciation Caps

depreciation 折舊計算 12MApa

The Maserati Quattroporte has the highest depreciation rate among luxury sedans, with an average loss of $90,588 over five years.. The luxury car market, on average, sees a 48.1 percent drop in.

How To Beat Depreciation And Own Great Luxury Cars! YouTube

Learn about luxury auto depreciation limits and find your maximum deduction for cars, trucks and vans used in business. Search Help Enter one or more keywords to search. Use quotes for "exact phrase." Note that '*' and '?' wildcards are supported.

Vehicle Depreciation All you need to know! Vinsure Insurance Brokers

Published Apr 18, 2022 We rank the fastest-depreciating luxury cars based on the amount of value they lose in the first five years of ownership. Audi Media Center Among all automotive segments, luxury cars tend to suffer the most from depreciation.

2018 LUXURY AUTO DEPRECIATION LIMITS, TABLES AND EXPLANATIONS

The tax law limits the amount you can deduct for depreciation of your car, truck or van. The section 179 deduction is also treated as depreciation for purposes of these limits. The maximum amount you can deduct each year depends on the year you place the car in service. The 2021 luxury vehicle tables appear below. 1 The tables show ·

Luxury Sedans And EVs Have Some Of The Worst Depreciation Rates Carscoops

Luxury auto caps rise under TCJA Luxury auto caps rise under TCJA One of the Code's more misleading terms has been the heading of Sec. 280F: "Limitation on depreciation for luxury automobiles" and, consequently, the name "luxury auto caps" commonly applied to the provision's limits.