Auto Mechanical Breakdown Insurance Hayes Company Insurance Brokers

Mechanical breakdown insurance covers repairs to your vehicle's essential components if your car breaks down. Insurance providers like Geico and AAA allow you to add this supplemental policy to.

Mechanical breakdown insurance covers 40 of 1200 repair bill Stuff

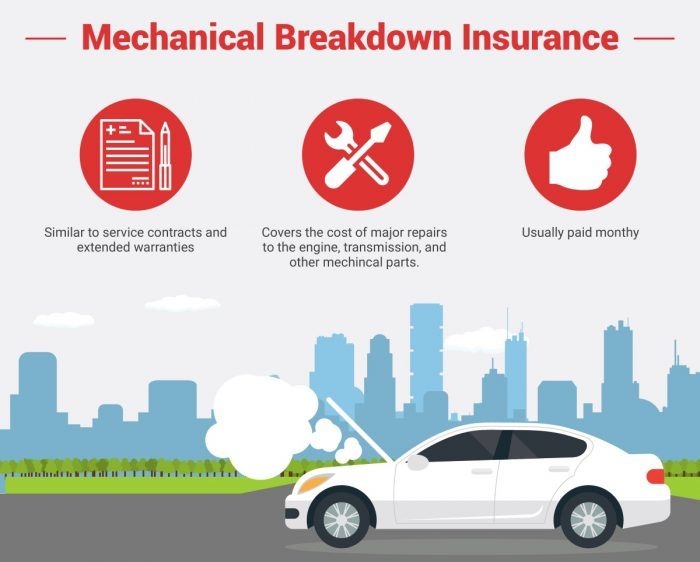

Overall, Mechanical Breakdown Insurance (MBI) is a type of vehicle insurance that provides coverage for the repair or replacement of mechanical parts of a vehicle that have failed due to normal wear and tear. It is an add-on option to standard auto insurance policy and it's important to carefully review the terms and conditions of an MBI.

mechanicalbreakdownautorepairinsurance Just Van Life

III. Benefits of Mechanical Breakdown Insurance . A. Financial protection . One of the main benefits of mechanical breakdown insurance for high mileage cars is the financial protection it provides. When a car has high mileage, it is more likely to experience mechanical issues and breakdowns. And unfortunately, these issues can be expensive to.

Mechanical Breakdown Insurance Fine Print Endurance Warranty

This is particularly true for high-mileage cars that are more likely to experience mechanical failures and breakdowns. In the following sections, we will explore the benefits of mechanical breakdown insurance for high-mileage cars in more detail, as well as the coverage offered, cost considerations, and tips for choosing the right policy.

Mechanical Breakdown Insurance

Mechanical Breakdown Insurance. Pros:. and high-mileage vehicles. Typically offers a prorated refund after 30 to 60 days. Cons: Doesn't cover wear and tear or routine services such.

Mechanical Breakdown Insurance Everything You Need to Know PrivateAuto

Over 60 and Looking For a Better Deal? Compare Seniors Car Insurance. Millions of Australians Trust Finder to Save Them Time & Money. We Can Help You Too.

State Farm Mechanical Breakdown Insurance Worth It? (2022)

If you need service, CarShield also offers the ability to choose your own mechanic, access to courtesy towing services, round-the-clock roadside assistance and, in some plans, reimbursement for.

What is mechanical breakdown insurance? INSURANCE MANEUVERS

A CARCHEX extended warranty can help you protect your car better than mechanical breakdown insurance. With a No-Haggle, Low-Price, Everyday Guarantee™, a 30-Day Money Back Guarantee, and an A+ rating from the Better Business Bureau, you can trust us for a low-cost extended warranty. Get My Free Quote 866-261-3457.

All the Different Types of Car Insurance Coverage & Policies Explained

The Ins and Outs of Mechanical Breakdown Insurance.. High mileage vehicles also stand a greater chance of breaking down or needing major work due to wear and tear. For example, a Honda Civic is known for its ability to run for hundreds of thousands of miles. Still, once the vehicle's odometer reaches 100,000, you have to.

Mechanical Breakdown Insurance Everything You Need to Know WalletGenius

Mechanical breakdown insurance for used cars is coverage for major parts of your car that are susceptible to expensive bills if they break down. These policies are offered by select.

Mechanical Breakdown Insurance Bankrate

Subscribe to AXA's Visa Schengen Insurance and get your certification instantly. Travel insurance accepted by member state consulates and embassies.

Geico Mechanical Breakdown Insurance Review (2022)

Mechanical breakdown insurance (MBI) is a type of insurance policy that covers the repairs or replacements of certain vehicle parts after they break down. Unlike standard car insurance,.

What does Mechanical Breakdown Insurance cover? SP Insurance

Without auto repair coverage, you'll pay for 100% of the costs of repairing your vehicle's mechanical problems with your own money. For many people, high vehicle repair bills aren't easy to cover. It's common for people who live on a tight budget or struggle to make ends meet to charge expensive car repair bills to a credit card.

What's The Difference Between Mechanical Breakdown Insurance And An

Mechanical breakdown insurance (MBI) is an insurance coverage you can get as a stand-alone policy or added on to your existing car insurance policy. MBI typically doesn't cover standard wear and tear or routine maintenance, but it will cover mechanical failure. While new cars may come with manufacturer warranties that cover mechanical defects.

Mechanical Breakdown Insurance Quote Andrews & Van Lohn Insurance in

Is mechanical breakdown insurance worth it? Compare mechanical breakdown insurance and extended car warranties to decide which is right for you. Overview Top Picks Cost Coverage More.

Mechanical Breakdown Avoiding a Breakdown

Mechanical breakdown insurance and extended car warranties may seem similar, but they have key differences.. Extended warranties are good options for high mileage cars, older cars, and used.