Tesla Slows Model S, 3, X Depreciation Through OTA Software Updates

Edmund's calculated an average total maintenance cost of $6272.00, repairs of $1892.00, insurance at $7400.00, fuel at $3119.00 and depreciation of $60K. All the data concluded the TCO for the Model X is the same as the original purchase price, approximately $100K. For perspective, the Audi Q7 is $69K new, but the TCO is $85K.

Tesla Model X Finance Calculator Financeinfo

A 2020 Tesla Model X has a forecasted 4 year depreciation rate of 40%. In 4 years its value is expected to decrease approximately $32,996 from its new price of around $82,490 down to $49,494. Click To View The TOP RATED Models In Our Depreciation Rankings Check Out Our Car Depreciation Calculator!

+22 Tesla X Depreciation Ideas

Depreciation $33,737 Taxes & Fees $3,843 Financing $13,184 Fuel $3,306 Insurance $6,652 Repairs $6,087 Maintenance $8,097 Ownership Costs: 5-Year Breakdown Selected Model: 2019 Model X SUV.

Exponential Function Application (y=ab^x) Depreciation of a Car YouTube

Tesla depreciation and current valuations Last updated 20-Dec-2023 We have captured the real world historic valuation of Tesla over the years, and while historic depreciation doesn't mean the future will follow the same path, it does help understand if the current prices are realistic or a bubble.

Image result for car depreciation curve Stuttgart, Curve, Lexus

Are you researching the depreciation rates in a Tesla Model X? On this page, we'll list all the depreciation information for the 5 years of data we have for the Tesla Model X - from 2016 to the most recent model in 2020. Tesla Model X Historical Depreciation Table

Depreciation Wikipedia

Depreciation $99,609 Taxes & Fees $6,058 Financing $34,155 Fuel $3,973 Insurance $6,822 Repairs $2,629 Maintenance $3,057 Ownership Costs: 5-Year Breakdown Selected Model: 2022 Model X SUV.

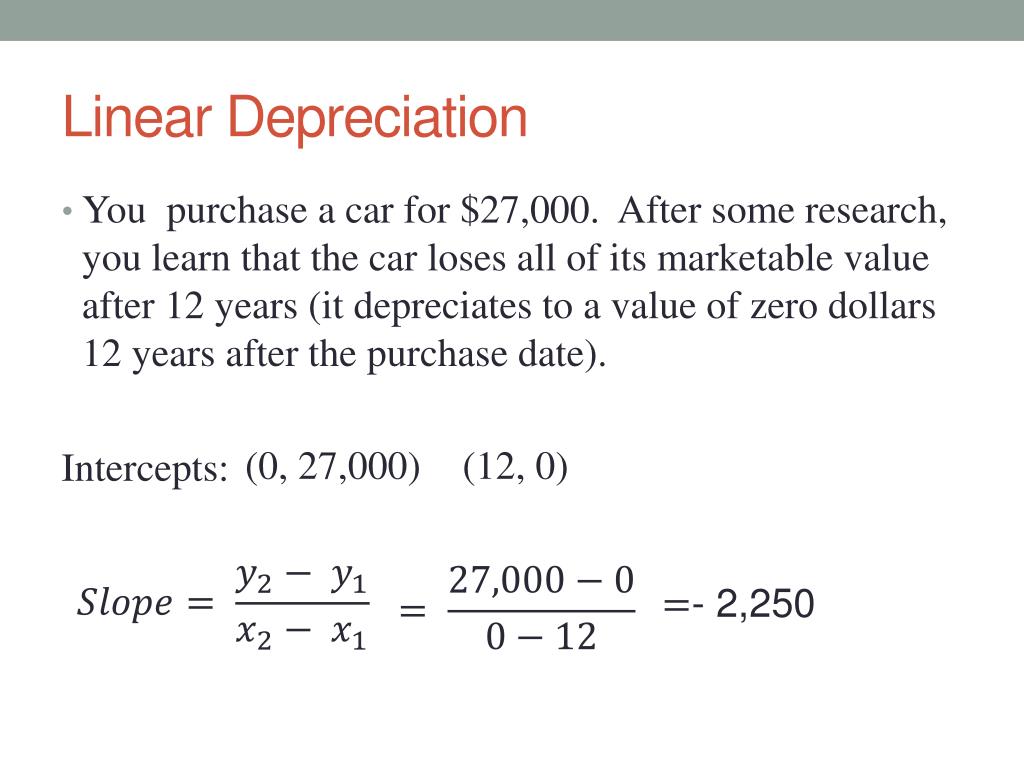

PPT Linear Automobile Depreciation PowerPoint Presentation, free

A Tesla Model X will depreciate 29% after 5 years and have a 5 year resale value of $79,566. The chart below shows the expected depreciation for the next 10 years. These results are for vehicles in good condition, averaging 12,000 miles per year. It also assumes a selling price of $112,461 when new.

How to Calculate Depreciation Methods Project Management Small

Those domestically assembled vehicles should be eligible for half the credit, or $3,750, a Kia spokesman said. Stellantis, which owns Chrysler, Dodge, Ram and Jeep, plans to introduce six mass.

Tesla Model X Finance Calculator Financeinfo

A Tesla Model X will depreciate 63% after 8 years and have a 8 year resale value of $43,604.. The chart below shows the expected depreciation for the next 10 years. These results are for vehicles in good condition, averaging 12,000 miles per year.

2023 Tesla Model S Plaid Review, Trims, Specs, Price, New Interior

2022 Tesla Model X Gross Vehicle Weight 6,250 lbs. Model X Qualifies for the 6000 Pound or more requirement (Per IRS) and using a combination of Section 179 and Bonus Depreciation. Tesla Model X Tax Write off California California has very specific rules pertaining to depreciation and limits any Section 179 to $25,000 Maximum per year.

Model X Depreciation....WoW! Tesla Motors Club

Model X offers a spacious cabin with the world's largest panoramic windshield and seating for up to seven. Up to 10 teraflops of processing power unlock in-car gaming on-par with today's newest consoles. A 17" touchscreen with left-right tilt offers 2200 x 1300 resolution, true colors and exceptional responsiveness for gaming, movies and more.

Depreciation Recapture Calculator 2023 IRS TaxUni

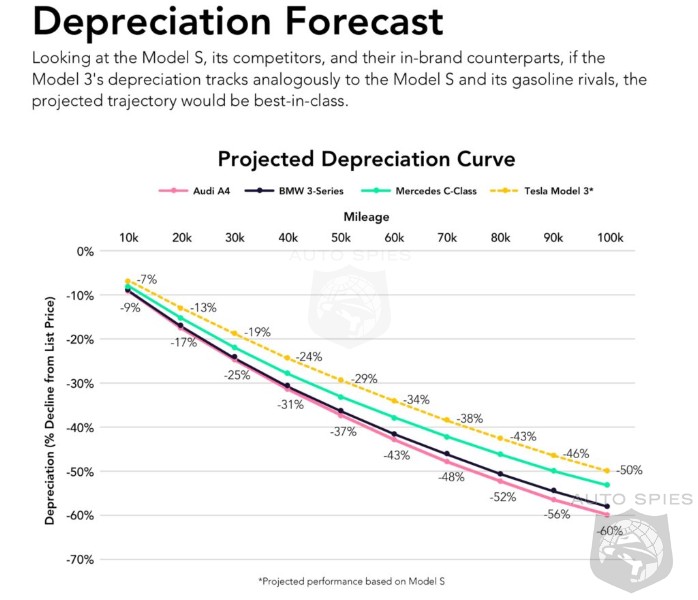

Like its sedan counterpart, the depreciation curve for the Model X from 10,000 to 100,000 miles consistently outperforms its gas-powered peers. These findings are based on 35,442 listings of unique, used Model S sedans on Autolist.com between January 1, 2012, and November 5, 2018.

8 ways to calculate depreciation in Excel Journal of Accountancy

The depreciation of a Tesla Model X varies, but generally, it experiences a significant initial drop in value, estimated at around 30% in the first year. Subsequent annual depreciation rates tend to stabilize at approximately 15%.

Best In Class Depreciation Tesla Model 3 Will Retain over 70 Of It's

Tesla Model X Section 179 and allowed Special Depreciation I bought a Tesla Model X on Nov 19, 2022 for $124,772. It is over 6000 lbs and I use it 55% for business. The total write off is $68,625. I set it up as an asset under "G - Tools, equipment"

What is depreciation? Geoffrey Dromard

Tesla offers the 2021 Model X in two versions, both using front and rear motors for all-wheel drive. For $88,490, the 670-horsepower Long Range model travels 360 miles on a full charge. Its.

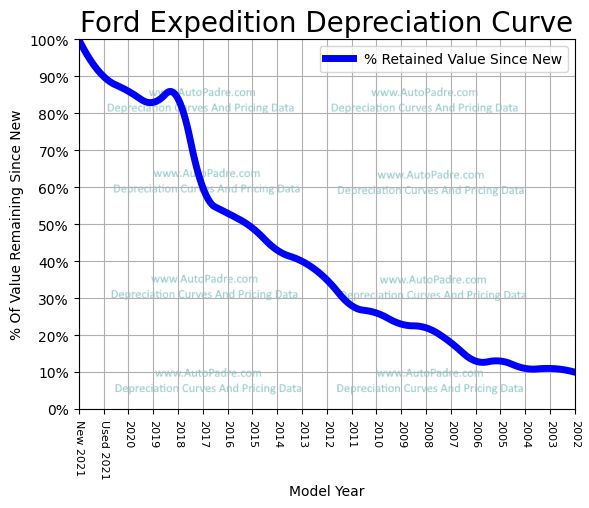

Ford Expedition Depreciation Rate & Curve

The Model X gets the full credit, while the Rivian gets half. But that shouldn't be an issue with the iX because you can't get any credits for used EVs unless they sell for below $25,000.