Jaguar XF Tax Write Off 20212022(Best Tax Deduction)

Model S; Model 3; Model X; Model Y; Additionally, Semi qualifies for a tax credit of up to $40,000. For the full list of current requirements for commercial clean vehicle credits, review the IRS website. Note: For businesses, the tax credits are nonrefundable, so you can't get back more on the credit than you owe in taxes. Tax-exempt entities.

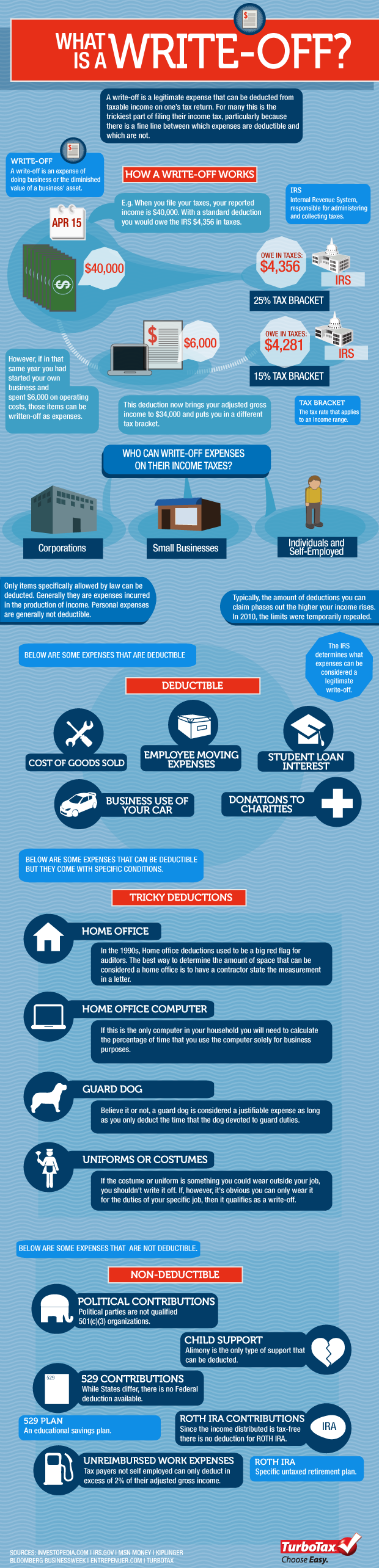

What is a tax writeoff and how does it work? Workhy Blog

Tesla Model X Tax Write off Weight 2022 Tesla Model X Gross Vehicle Weight 6,250 lbs. Model X Qualifies for the 6000 Pound or more requirement (Per IRS) and using a combination of Section 179 and Bonus Depreciation. Tesla Model X Tax Write off California

Lexus NX Tax Write Off 20212022(Best Tax Deduction)

Model X TESLA X section 179 EXOTIC1 Feb 22, 2020 1 2 3 Next EXOTIC1 Member Jan 23, 2014 697 501 MANY PLACES Feb 22, 2020 #1 Does the X qualify for a section 179 ? I seem different answers hopefully someone can explain that knows for sure. I was told if it does qualify purchase can be new or used M msm859 Member Oct 23, 2019 690 1,070 California

What is a Tax WriteOff? (Tax Deductions Explained) The TurboTax Blog

7 Examples of tax write-offs. 1. Medical and dental expenses. Medical and dental expenses can be claimed as itemized deductions but only to the extent that the total amount of such expenses.

7 Tax WriteOffs You May Be Missing in 2021 Tax write offs, Writing

The Inflation Reduction Act set MSRP caps on what vehicles can qualify for the $7,500 tax credit, with a threshold of $55k for cars and $80k for trucks and SUVs. Prior to now, the Model S and.

What Can I Write Off on My Taxes? Business tax deductions, Tax write offs, Tax deductions

Tesla Model X Section 179 and allowed Special Depreciation I bought a Tesla Model X on Nov 19, 2022 for $124,772. It is over 6000 lbs and I use it 55% for business. The total write off is $68,625. I set it up as an asset under "G - Tools, equipment"

This video is a tax writeoff. YouTube

I've seen clients use this deduction as a legal write-off on a G-Wagon, a Tesla Model X and even a Rolls Royce Cullinan. These cars are valued anywhere between $150,000 to $350,000!

Tesla Model S Tax Write Off 20222023(Best Tax Deduction)

Oct. 13, 2015 3:44 AM PT Elon Musk and Tesla Motors, masterful at mining state and federal tax incentives, may have lucked into a tax loophole. The company's new $100,000-plus Model X.

Buy a Truck or SUV Before Year End, Get a Tax Break Small Business Trends

For 2017, Section 179 allows you to deduct $11,160 for smaller vehicles and $25,000 for vehicles over 6,000 pounds. There are a few restrictions: • The vehicle must be used more than 50% of the time for business purposes; • The vehicle must be a new purchase for the business, it cannot be contributed property;

Model X tax credit question Tesla Motors Club

Seconding ccb621 - talk to a business accountant/tax professional. As a former small business owner, using a vehicle for a small business is fraught with tax issues. Don't trust any random internet advice that says "sure, just write it off!" Talk to an actual accountant/tax professional. There are a lot of things to consider - including.

What's A Tax WriteOff? YouTube

As of January 1, 2023, Americans can claim a $7,500 tax credit when buying a Tesla (and other electric vehicles). The Inflation Reduction Act allows eligible buyers the opportunity to claim a clean vehicle tax credit of up to $7,500 under Internal Revenue Code Section 30D.

Buick Envision Tax Write Off 20212022(Best Tax Deduction)

Who qualifies. You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032. The credit is available to individuals and their businesses.

Tax Writeoff Template Just One Dime

This question has indeed been asked many times. You can only deduct the % (has to be more than 50%) used for business. Commuting miles don't count. Having said that, due to the 2017 Trump tax act, the way to write off 100% of the total cost (up to $1M) is to buy an MX toward the end of the year, say the last week of 2020.

Tax WriteOff Myth 2 No No Tax Write Offs

1. 2021 Tesla Model X We personally love this car! And if you're like us, get it whenever you can to strategically use the vehicle tax deduction. So the 2021 Tesla Model X vehicle GVWR (Gross Vehicle Weight Rating) comes in weighing 6,788 to 6,878 lbs which means it easily qualifies for accelerated vehicle depreciation.

Cadillac XT4 Tax Write Off 20212022 (Best Tax Deduction)

The Tesla Model X officially qualifies for a $25,000 business tax deduction due to its GVWR being over 6,000 pounds.

19 Independent Model's Tax Write Off with Keeper Tax write offs, Business tax deductions

23 Tax Write-Offs for Models 23 Tax Write-Offs for Models Reviewed by a tax professional NAICS code: 711510 Modeling seems easy to some people, but that's only because you make it look that way. The truth is that it requires a lot of time, discipline, and of course: expenses.