Land Rover Discovery Tax Write Off 20212022(Best Tax Deduction)

Section 179 vehicles can earn you massive tax deductions, but your vehicle must meet certain criteria. Read this guide before you buy.. 2022 Range Rover P525. This high-end, luxury SUV comes equipped with a 518 horsepower, V8 engine. It has a $105,950 MSRP and 6,967 pound GVWR, and qualifying business owners can deduct $26,200 under Section.

Range rover depreciation calculator MervynTanisha

Deduction Limit. The deduction limit—how much a company can deduct in a tax year—is $1,160,000 for 2023. Companies also can't claim more than their net income for the taxable year. So if a business makes $250,000, it can only deduct up to $250,000 for qualifying equipment.

Range Rover 179 Tax Deduction shorts YouTube

The IRS allows up to $25K up front depreciation (100%) for SUV over 6,000 lbs PLUS 50% Bonus Depreciation for NEW vehicles which will get close to that figure. The vehicle must be driven over 50% of the miles for business purposes. Further, you must reduce the $25K by the personal use percentage. Not bad!

2021 Land Rover Range Rover Reviews, Pricing & Specs Kelley Blue Book

Buying a Business Vehicle that is more than 6000 Pounds is an excellent Tax Write Off. Section 179 Vehicles can help you save thousands of dollars in Taxes.. Pingback: Range Rover Over 6000 Pounds - suluovagazete. Pingback: Range Rover Over 6000 Pounds - brujasdeaskani. Leave a Reply.

range rover sport tdv6 cheap tax model in Bodmin, Cornwall Gumtree

There are two methods for this: You have the standard mileage rate deduction which calculates how many business miles you have driven and gives you a deduction based on that. And then you have the actual expenses deduction which allows you to write off the direct costs of the vehicle including depreciation.

Range Rover Vouge SE Cheap TAX in Kirkcaldy, Fife Gumtree

Did you know that if you have a Range Rover, you can write it off on your taxes? It's true! The full amount of the purchase price can be deducted from your taxable income. So whether you're self-employed or own your own business, Range Rover ownership could save you some money at tax time.

1971 Range Rover Tax is due in 6 days, so lets see if this… Flickr

The Land Rover lineup is an ideal addition to your business, and thanks to Section 179, you may qualify for a sizeable tax write-off on many of our models including the Range Rover, Range Rover Sport, and Land Rover Discovery. View Inventory 2019 Tax Year Section 179 Overall Limit……………………………………………$1,000,000

Taxes You Can Write Off When You Work From Home [INFOGRAPHIC

You can also apply the Section 179 tax incentive toward used vehicle purchases, so be sure to browse our pre-owned Range Rover inventory to see what we have in store. The 2022 Section 179 deductions for passenger vehicles are: Cars: $11,160 (including Bonus Depreciation) 1. Trucks & Vans: $11,560 (including Bonus Depreciation) 1.

How to get every tax writeoff you deserve Chime

Range Rover VS. Luxury Car Range Rover¹ 100% Depreciation $93,800 Luxury Car² 20% Depreciation $18,200 VIEW RANGE ROVER INVENTORY $70,900 Range Rover Sport* VS. $70,900 Luxury Car Total allowable depreciation for the 1st year of ownership* Range Rover Sport VS. Luxury Car Range Rover Sport¹ 100% Depreciation $70,900 Luxury Car² 26% Depreciation

Can You Write Off a Range Rover? (Here’s What You Need to Know

If the algorithm has been feeding you "get rich quick" content, you've probably seen videos about the Range Rover Loophole, also known as the G Wagon write-off. But can you actually get a tax write-off for a luxury car? Nicole explains. Want to start investing, but don't know where to begin? Go to…

how to write a tax write off cheat sheet Tax write offs, Business tax

The tax write-off is known as the Section 179 deduction, which allows you to deduct the cost of qualifying vehicles from your taxable income. However, there are a few factors to consider. Firstly, the vehicle must be used primarily for business purposes and not for personal use.

Rewarded Cyberzine Navigateur

With the election of the special depreciation allowance, this amount increases to $11,160 for the year. If you choose the standard deduction amount and drove 50,000 miles in 2021, you would apply the standard mileage rate of .56 cents per mile to get a $28,000 deduction. If you purchased a new car, Section 179 may give you a larger deduction.

Rover RANGE ROVER TAX EXEMPT GREEN LANE in Long Eaton

It is free if you only make a few trips per month or $59.99 a year and that expense is also deductible. Don't forget clothing articles, shoes, leashes, poop bags, client gifts--long list--are also business expenses and can be deducted on your taxes. Comments

Land Rover Tax Advantage Land Rover Cary

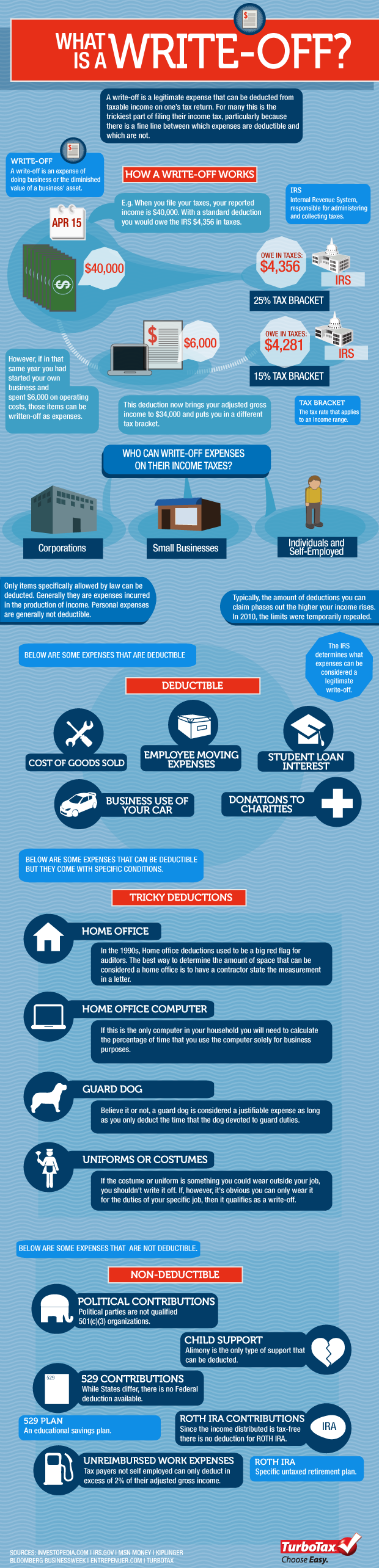

A write-off is just a sum of money that you can subtract from your taxable income. So this means you'll pay less in taxes overall since you're taxed on a smaller amount.

What is a Tax WriteOff? (Tax Deductions Explained) The TurboTax Blog

If you are looking to purchase a luxury vehicle for your business and are looking for a tax write-off, make sure to do it like a true tax professional. There are two ways to write off.

Road Tax Changes Farnell Land Rover

Range Rover ¹ 100% Depreciation $93,800 Luxury Car ² 20% Depreciation $18,200 VIEW RANGE ROVER INVENTORY $70,900 Range Rover Sport* VS. $70,900 Luxury Car Total allowable depreciation for the 1st year of ownership* Range Rover Sport VS. Luxury Car Range Rover Sport ¹ 100% Depreciation $70,900