Delaware Sales Tax and Other Benefits of Incorporating

All you have to do is hand over the money for the car and make sure the seller gives you the title and a bill of sale. Then after that, you have 30 days to get your paperwork in order and get your car titled and registered in your name. The best advice to take in this situation is do this "sooner than later".

Delaware Sales Tax Sales Tax Delaware DE Sales Tax Rate

Is there a sales tax for cars in Delaware? No. Delaware is one of the states that doesn't charge sales tax on cars. However, all car purchases in the state are subject to a 4.25% documentation fee. The fee gets fixed based on the buying price or the NADA book value, which is higher.

Gross McGinley Online Sales Subject to Sales Tax

The Delaware state sales tax of 0% is applicable statewide. You can view the sales tax rates for various cities in Delaware Did you find what you were looking for? The Delaware sales tax rate is 0% as of 2023, and no local sales tax is collected in addition to the DE state tax. Exemptions to the Delaware sales tax will vary by state.

The Best Sales Tax Software of 2022

Delaware: No sales tax Florida: 6.00% to 7.50% Georgia: 4.00% to 8.90% Hawaii: 4.00% Idaho: 6.00% to 8.50% Illinois: 6.25% Indiana: 7.00% Iowa: 5.00% to 7.00% Kansas: 6.50% Kentucky: 6.00% Louisiana: 5.00% Maine: 5.50% Maryland: 6.00% Massachusetts: 6.25% Michigan: 6.00% Minnesota: 6.50% to 8.875%

Utah’s New Tax Bill By Common Consent, a Mormon Blog

The Delaware DMV will issue a temporary tag to the new owner for a fee of $20. The buyer must provide proof of insurance, the bill of sale, and a description of the vehicle, including the vehicle identification number (VIN). Please contact the Delaware Division of Motor Vehicles (DMV) for more information.

To What Extent Does Your State Rely on Sales Taxes? Upstate Tax

Delaware Sales Tax on Cars As you consider buying a new vehicle, you should be aware of Delaware sales tax on cars and any additional fees. It's also beneficial to stay current on the varying.

Sales Tax

Introduction What is Delaware Sales Tax for Cars? Delaware does not have a sales tax for cars. This means that when you buy a car in Delaware, you will not have to pay any state sales tax. However, there are other taxes and fees that you may have to pay when you buy a car in Delaware, such as document fees, title fees, and registration fees.

Delaware'de Kurulu Şirketler için KDV Bilgilendirmesi Delaware Şirket

If you're purchasing a new car, a sales tax of 6% is added to the price. If you're re selling your vehicle , this is also considered a sale and subject to sales tax. These fees and taxes paid to the Delaware Department of Finance are for the protection of your license plates and registration.

Grand Rapids Coins Charges No Sales Tax on Coins Bought In Michigan

No Sales Tax on Cars One of the key benefits of buying a car in Delaware is that there is no sales tax applied to vehicle transactions. This policy can save buyers significant amounts when purchasing a new or used car, as even a small percentage of sales tax can equate to hundreds or thousands of dollars added to the purchase price.

Filing NYS Sales Tax 10 Must Know FAQs Due Dates, Penalties, etc.

Updated on Jun 12, 2023 Table of Contents There is no state sales tax in Delaware—but before you cross state lines to save money on buying a car, note that the car must be registered in Delaware to skip the sales tax. QUICK LOOK

How To Register for a New California Sales Tax License (a StepbyStep

Since there is no sales tax if you purchase the vehicle in Delaware, there is no tax to calculate. As an example, if you purchase a new sedan in Delaware for $45,000, then the sales tax for that vehicle will be $0. Other States with No Sales Tax On Cars

SaaS Sales Tax for the US A Complete Breakdown

The Delaware (DE) state sales tax rate is currently 0%. Delaware does impose a "… gross receipts tax on the seller of goods (tangible or otherwise) or provider of services in the state.". Delaware was listed in Kiplinger's 2011 10 tax-friendly states for retirees.

Delaware Tax Sales Redeemable Tax Deeds YouTube

While Delaware does not charge sales tax, the state charges a 4.25% "motor vehicle document fee" on most used vehicle purchases, including private party sales. Do You Pay Taxes When You Buy a Car From a Private Seller in Delaware? When you buy a car in Delaware, whether from a private party or a car dealer, you do not have to pay sales tax.

Should States Charge Sales Tax To Online Business?

Get 20% Off Enter SAVE20 at checkout See All Benefits Car Sales Tax by State In the table below we show the car sales tax rate for each state. States with No Sales Tax There are some states that do not charge any sales tax on cars. The states with no car sales tax include: Alaska Delaware

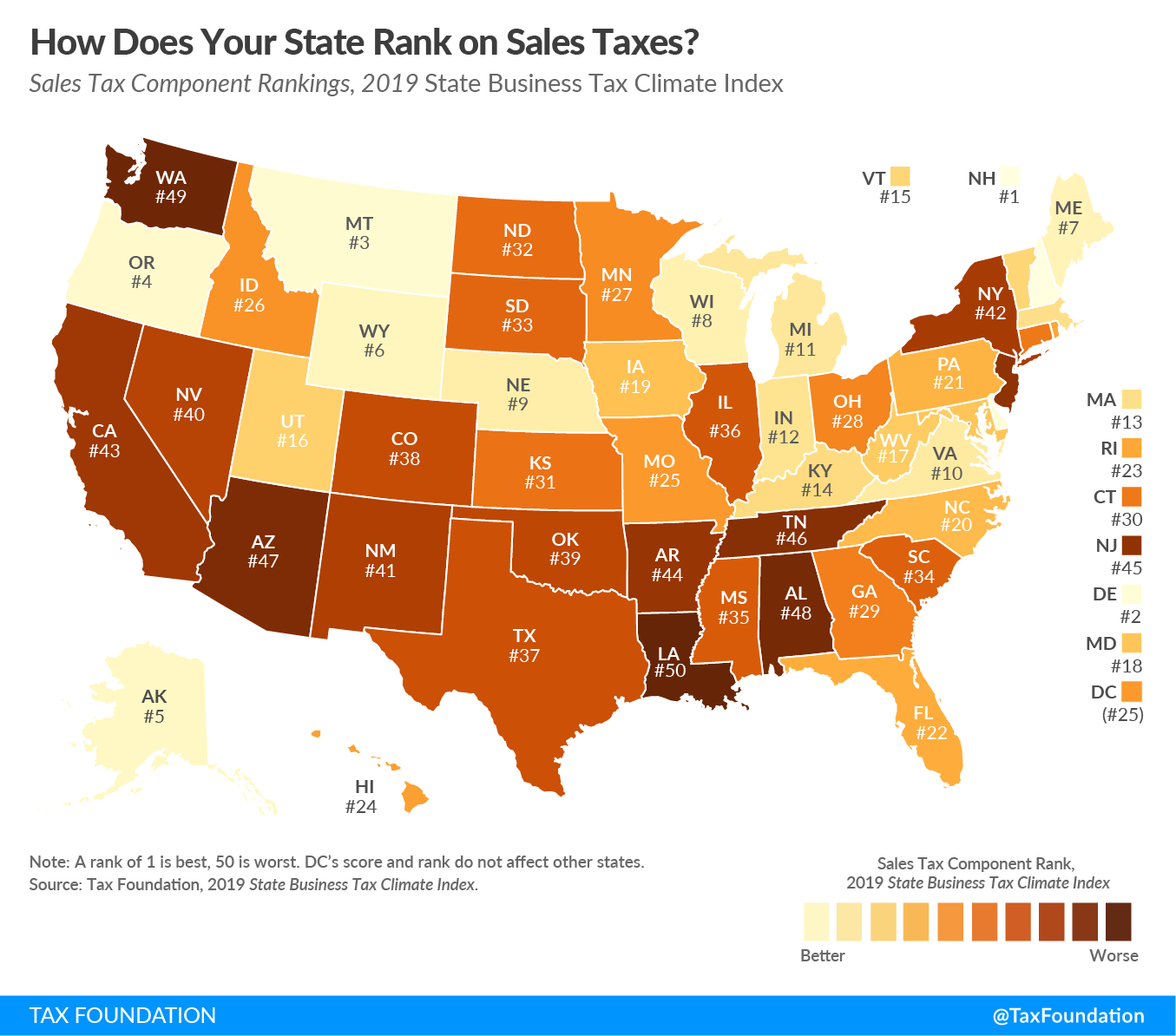

Ranking Sales Taxes on the 2019 State Business Tax Climate Index The

While Delaware does not have a sales and use tax on retail sales, it does have several other taxes in addition to its gross receipts tax. Businesses may pass the gross receipts tax and other taxes onto consumers. Separate jurisdictions do not have local sales taxes they can add to the state sales tax.

Progressive Charlestown Charlestown Tapas

Will it cost more? The retail prices for electric vehicles are slightly higher than combustion engine vehicles. According to July 2023 Kelley Blue Book values, the average price for a new internal.